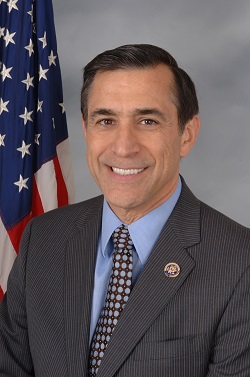

Rep. Darrell Issa (R-Calif.), chairman of the House Oversight Committee, said Congressional deregulation and the resulting pressure to grow forced credit unions to become more like banks. And, that pressure has fueled banker resentment.

Rep. Darrell Issa (R-Calif.), chairman of the House Oversight Committee, said Congressional deregulation and the resulting pressure to grow forced credit unions to become more like banks. And, that pressure has fueled banker resentment.

Issa made the comments while speaking at an event sponsored by the Libertarian-leaning Washington think tank CATO Institute regarding Operation Choke Point, a Department of Justice initiative that pressures financial institutions to cut ties with private companies that aren't breaking the law, but could increase reputation risk.

Issa veered into credit union territory when he said that compared to banks, credit unions are a bit more protected from Operation Choke Point.

“Credit unions so far have been slightly more insulated, but credit unions have a separate attack which is that when we deregulated credit unions, what we did was we created the same race to be a large credit union,” he said July 8 at the event, “DOJ's Operation Choke Point: Illegally Choking Off Legitimate Businesses?”

Issa likened a credit union to a fraternal organization that serves its members. However, he said credit unions are becoming more like banks over time.

“What we've done is we've said to credit unions get big or die, and so what you're seeing is they're all changing their stripes and becoming bank-like. My guess is that ultimately credit unions are on a – unless we change something – they're on a pathway toward choosing to be banks,” Issa said.

“Part of the reason is that the banks continue to attack credit unions because they can assemble base capital without taxation and for some reason, banks have always disliked credit unions, but once they started being more bank-like and getting larger, that war has been going on,” he added.

Reacting to Issa's comments, John Magill, CUNA executive vice president of government affairs, stressed that while credit unions provide many of the same services as banks, their structure and mission are quite different.

“Bank attacks and resistance toward credit unions are as old as credit unions themselves, documented at nearly every stage of credit union development in this country going back more than 100 years,” Magill said. “But what the banks have never understood is that credit unions operate under a completely different structure: Not-for-profit, member owned, democratically controlled, volunteer led-financial institutions, focusing on service to members – not shareholders' bottom lines.”

“It's true that there are many credit unions that are not small by community bank standards. However, all credit unions adhere to the same structure — and the focus is on service to their members. It's for that reason that nearly one in three Americans now choose credit unions as their financial partner,” he added.

According to CUNA Vice President of Political Affairs Trey Hawkins, CULAC contributed $7,750 to Issa's re-election campaign in the 2012 cycle, and $7,500 so far for the 2014 cycle.

NAFCU's PAC donated $2,000 to Issa in the 2014 election cycle, according to online records.

Senior Vice President of Government Affairs and General Counsel Carrie Hunt disagreed that credit unions face pressures to grow due to deregulation. Rather, she said, the issue is a need for economy of scale.

“Credit union merger trends have been consistent and are due to regulatory burden and a need for economies of scale. Chairman Issa has highlighted the need for continued regulatory relief for all credit unions , especially smaller ones, in order for them to remain viable. However, regardless of size, credit unions remain not for profit mutual cooperatives. NAFCU believes that from a competitive standpoint, the real competitive threat for mid-size banks are even larger banks, not credit unions,” she said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.