If you click onto the Evansville Teachers Federal Credit Union website and check the list of eligible organizations, you'll find yourself scrolling through more than 1,200 SEGs.

If you click onto the Evansville Teachers Federal Credit Union website and check the list of eligible organizations, you'll find yourself scrolling through more than 1,200 SEGs.

In fact, the list is so extensive you'll be invited to select the appropriate section of the alphabet if you're, say, an employee of Acura Engineering or Showplace Cinemas. That lets you more quickly confirm you are eligible to join ETCU.

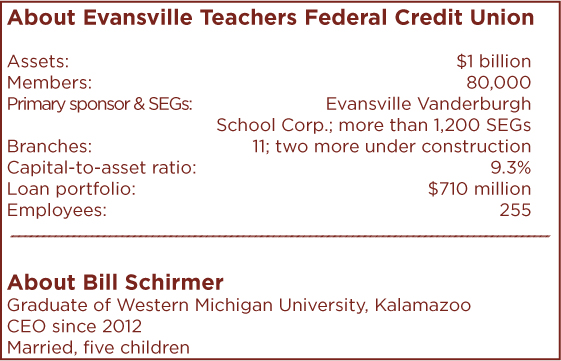

Perhaps that wide field of membership is at least part of the reason the Indiana credit union joined the Billionaires Club this year.

However, President/CEO Bill Schirmer indicated that although teachers form a smaller portion of the membership base each year, they're still a significant group.

“We have such a large percentage of the teacher population in our membership base–probably 65 to 75% of teachers are members –that they still comprise 45 to 50% of our total membership, about 35,000 to 40,000 of our 80,000 members,” he said.

Schirmer suggested that if you walk into an ETFCU branch, you will likely see a range of members from retired teachers to young families.

“They come in and we serve lemonade, coffee, doughnuts and cookies,” he said. “It's definitely member service that sets us apart. We also just recently rolled out an online banking platform so members can see all their financial relationships with daily updates.”

That online banking program also includes what ETCU calls Purchase Rewards, which Schirmer believes definitely separates ETFCU from other credit unions and banks. Purchase Rewards offers 10% to 20% back on a monthly basis from various stores selected by a member from a list. A member can shop the merchant online or in the store using an ETFCU debit card to earn the rewards.

Looking ahead, ETFCU would like to expand into the Indianapolis area and upstate Indiana. But there's strong competition from regional banks, including some that also have offices in Michigan, Kentucky and Illinois. In addition there are local banks, for example German-American Bank, plus national names such as Fifth Third and Chase.

To contend, “We have a very strong indirect lending program that has driven a lot of loan growth,” Schirmer continued. “We have more than 150 dealers in the state of Indiana in our program.

“Our loan growth has been substantial over the last two years at about 25 to 30%, and our indirect loans about 50 to 55% a year. That's something we're very proud of. It's really driving our return to members.”

Another factor helping ETFCU vie for loans is what Schirmer considers a very strong program to help first-time homebuyers with incomes at or below 80% of the median income in the county where they live. Buyers must contribute 5%, with a minimum of $1,000, toward the purchase.

“It's underwritten through the Federal Home Loan Bank of Indianapolis,” the ETFCU executive explained. “They had extra funds set aside this year, so we're doing a joint venture with them.”

There's also an Extra Credit mortgage program offering 1/8 of a percentage point on the APR of a first mortgage for members who open a checking account with debit card before the mortgage closing and sign up to have mortgage payments automatically deducted from the checking account.

Then there are Purchase Plus mortgages offering a $500 Visa gift card.

ETFCU members also noticed a new statement format starting with the June 30 statement, thanks to a just-completed data processing conversion.

“It's much more of a relationship statement, a household statement,” Schirmer said.

The revised statement includes information for all of a member's deposit accounts, including shares, checking, certificates and retirement accounts. Loan information will soon be integrated into the new statement. Statements will be monthly if a member has a checking account or electronic transaction; otherwise they will be issued quarterly.

Schirmer began his career with a public accounting firm in Grand Rapids, Mich., after graduating from Western Michigan University in Kalamazoo with a degree in business.

After three years there he joined a Grand Rapids bank, then moved on to Lake Michigan Credit Union where he worked more than 18 years, ending up as CFO and vice president.

In 2012 he accepted the CEO job at ETFCU.

His management approach reflects that of many other CEOs at $1 billion credit unions who have learned it's important to delegate.

“I really see that the leader's role in a credit union this large is to find the talent, lay out the plan, and let the staff carry it out. That's definitely my style. We had a very strong staff when I got here. The board has been very supportive of our mission and our direction,” Schirmer said.

“Evansville is a nice Midwestern town. It's slow paced, the people are very hospitable, and I have no complaints whatsoever.”

Schirmer and his wife have five children, ranging in age from 7 to 13. Two of the children were adopted from Guatemala.

“My wife is a stay-at-home mom. I think she works harder than I do,” he declared.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.