It was five years ago, March 2009, when NCUA seized WesCorp and U.S. Central, and thus began a shakeup that would completely redraw the map of corporate credit unions and their spokes. That story has been told, extensively, in CU Times.

What has not been told is the human side of the story.

Here is a beginning of that storytelling, as three who had risen high in the world of corporate credit unions have since found themselves thrust into second acts in their lives.

Read more: Thomas Bonds …

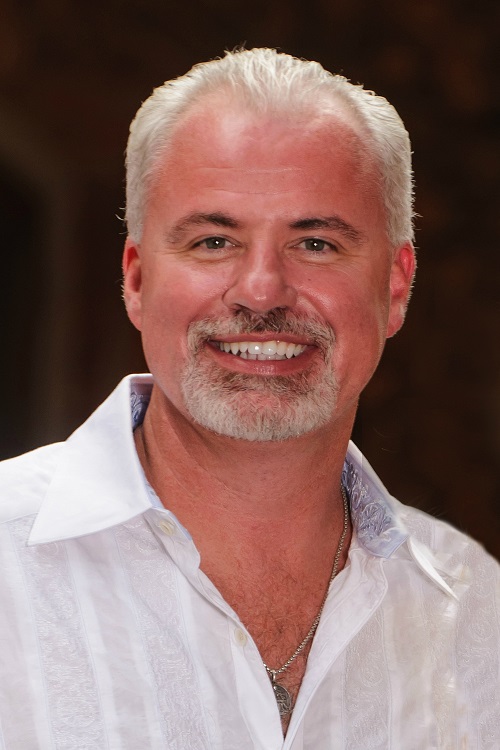

Thomas Bonds

Thomas Bonds

Former CEO of Corporate America

CU Times 2011 Trailblazer CEO of the Year

The end came for Thomas Bonds' reign at Corporate America in early July 2012. That's when it was announced that the CEO of the Irondale, Ala-based corporate credit union was leaving the corner office.

Two years later there are still moments when “sometimes I wish I were still at Corporate America. It's a great institution,” said Bonds, who still isn't ready to discuss the why of his departure.

But Bonds quickly added, “Most of the time I am very comfortable in that decision.”

Look up Bonds now and he is in Orange Beach, Ala., on the Gulf Coast, 285 miles due south of Irondale.

“The ocean breeze is blowing continuously,” he said.

He runs Bonds Capital Group, a branch office of San Antonio-based Investment Professionals, Inc., an investment brokerage and asset management firm. His work to-do list is to first analyze a client credit union's investment portfolio, then advise it on other investment opportunities. And, lastly, sell those credit unions' investment products to round out their holdings.

Ask Bonds will tell you, he's living the good life now.

“I've lost 20 pounds, I work out three days a week, I wake up every morning whistling,” he said.

But, he acknowledged, “There's not that steady paycheck. Sometimes there are sleepless nights. I hope we can build the company up. At this stage we are doing well, we are pleased with the progress we are making.”

At Corporate America, Bonds felt he had a special expertise in helping natural person credit unions fine tune their investment portfolios. That, in essence, is the mission of Bonds Capital, where he said he has 23 to 25 clients.

Most of them, he said, had an affiliation with Corporate America.

“It took around four months to get Bonds Capital going. I started working on it as soon as I left Corporate America. We did our first trade in December, 2012. It closed in January, 2013.”

He added that the firm's goal is to help credit unions that are flush with cash invest without increasing their interest rate risk.

“This is fun. This is where it ends for me,” he said.

Read more: Francois Henriquez …

Francois Henriquez

Francois Henriquez

Former General Counsel and CEO of U.S. Central

Francois Henriquez, longtime general counsel at U.S. Central FCU, was promoted to CEO when NCUA put the corporate into receivership. He knew his job would end because he knew U.S. Central was winding down.

When the lights were turned off in his office, it did not come as a surprise.

But, in his mid-50s, the termination came as something of a liberation; even a rebirth.

He did something he thought he would never do. Or more precisely, he did two things.

He moved back to South Florida, where he had grown up and lived until he went away to college at Yale.

And he took a job at Shutts and Bowen, a large, Florida-based law firm with a focus on financial institutions.

“I never thought I would live in Florida again and I never thought I'd work in a law firm again,” said Henriquez, who worked for a couple of law firms after law school.

But when Shutts and Bowen initiated conversations with him about his plans post U.S. Central, he said he welcomed the new direction, mainly because he is surrounded by top legal talent and the clients — in his case, primarily credit unions — are also top notch.

To work at Shutts and Bowen, he had to pass the Florida bar exam, and it had been decades since he had sat through those grueling exams. Keep in mind that bar exams, aimed primarily at 25-year-olds, test generalist knowledge of the law.

For decades, Henriquez had honed highly specialized legal knowledge.

So he had to bone up.

“I passed,” he said, with what sounded like relief.

He was not the oldest person in the room, he insisted, although probably he was among the 10 oldest.

Another plus: “I left my snow shovels behind in Lawrence, Kan.”

Now he lives in a Miami-area apartment with a view of Biscayne Bay. And even sweeter, his commute to work is 10 minutes. In Kansas, it had been 45.

“I have lost 20 pounds. I run four times a week. When you don't spend 90 minutes a day in the car, you have a lot more time to get things done,” he said.

At Shutts and Bowen, Henriquez said, he works with around 85 credit unions, mainly natural person but with a few corporate credit unions in the mix. Some of the engagements are precisely defined; in other cases, they represent ongoing work. He said he speaks with three or four times every day.

“My clients don't know it, but there are times when I am sitting on the beach with my laptop, doing legal work. You can't beat that. This is as though it was meant to be,” he said.

Read more: Brian Hague …

Brian Hague

Brian Hague

Former CEO of CNBS

Brian Hague had been CEO at Kansas City investment CUSO CNBS for 15 years, and employed there for eight years prior, when he got pink slipped in April 2013.

He declined to discuss why the relationship fractured, other than to say that his departure “did not come as a surprise.”

There had been lots of changes at the CUSO leading up to his exit. Once solely owned by U.S. Central, in late 2012 CNBS became majority owned by Dallas-based Aberdeen Capital, where former Texans Credit Union CEO David Addison was a partner and a founder.

“Was I ready to go? Not in the way I did,” Hague said. “I was ready for several years, however. In hindsight I was ready for a change.”

Within a week of leaving CNBS, Hague picked up the phone and on the other end of the line was Dan Kampen, a partner at Overland Park, Kan. consulting firm The Rochdale Group, and a past CEO at U.S. Central. He asked Hague if he wanted to do consulting work.

Hague, who had spent the past two decades focused on investments, jumped at the chance to work with a firm that mainly focuses on enterprise risk management, strategic planning and similar topics somewhat removed from investments.

“I had always wanted to do this,” said Hague, who added that for some years he had been teaching courses in organizational management and strategy at the University of St. Mary in Leavenworth, Kan.

Even so, Hague said, “After 22 years at CNBS the old dog did have to learn new tricks. I was ready for a new challenge. I had run out of dragons to slay [at CNBS].”

The typical Rochdale Group engagement is a full bore risk assessment for a credit union. In a meticulous process that may take two or three weeks, Rochdale experts sit down with pertinent credit union staff in the operating units — IT, branches, consumer lending, down the line — and talk about key processes, risks, how the risks are managed and what more can be done.

The tasks were utterly different from what he wrestled with at CNBS, but Hague said, “I have a real appetite for research. I read a ton. I asked a lot of question. I went out on a couple of engagements. By the second week, I was helping to lead the engagement.”

It seemed to click for all concerned.

“Early this year, [managing Rochdale partner] Tony [Ferris] asked me if I was interested in a fulltime role. I was and am.”

“I wanted to be CEO at CNBS, I wanted to put my imprimatur on it. But I don't like dealing with the stuff, the HR stuff that a CEO has to deal with. We once had a downsizing. I was in tears letting people go, it wasn't their fault,” he said.

“I am solving other peoples' problems now. I love that. But I don't like owning the problems.

This has been a big stress relief,” he added.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.