Snubbed by lenders, entrepreneurs are taking their pitches to the people to secure funds for what some might consider risky investments.

Snubbed by lenders, entrepreneurs are taking their pitches to the people to secure funds for what some might consider risky investments.

One of the latest players entering the crowdfunding space help auto dealerships build capital by offering competitive loans with the ability to earn interest each quarter.

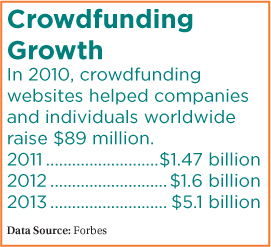

Crowdfunding is rapidly becoming an alternative way to raise money and in some cases, eliminating middlemen such as credit unions and banks. The general idea is the person seeking capital will solicit financial contributions from the public through a campaign that is often created online. In return, donors traditionally receive a future return on their investment.

Recommended For You

For credit unions, these new crowdfunding models are certainly ones to watch but opinions are mixed on whether they could become true auto lending competitive threats.

Among them is VroomBank, an Internet portal created by Braeger Financial Group LLC, a Glendale, Wis.-based, privately owned, automobile financing source. VroomBank helps independent car dealers who offer their own retail sales contracts and leases to continue to service and collect on those loan notes until maturity.

Investors can take part in three different note offerings at rates of 7%, 8% and 9% with terms of three, four and five years. Investor's monies are then placed with automotive finance companies that are held at a FINRA member brokerage firm, according to Braeger Auto Finance.

Investors do not make loans directly to the auto dealers or directly into pools of auto loans that VroomBank purchases. Rather, the notes allow accredited investors to take part in the loans offered to auto dealers' finance companies, as well as the auto loan pools that VroomBank may buy.

While the notes are backed by the receivables due from the auto dealer borrowers and the collateral of the borrower's portfolio of loans, they do not represent an ownership interest in the corresponding auto dealer loans or loan pools that VroomBank buys, their proceeds, or in the assets or equity of Braeger Auto Finance.

"As for peer to peer lending, or in our case, peer to business, the reason I feel this will become a great alternative is that it is easy. When it comes down to it, credit unions and in time, banks, will have to take on this business model as one form of distribution for lending," said David Braeger, president/CEO of Braeger Financial Group, who believes credit unions will move further into this auto investment space given the potential for high returns. He said a Michigan credit union is now looking at VroomBank's platform.

"The bottom line is for the first time, individuals have the ability to take part in the incredibly lucrative business of auto finance, which was once closed to institutional investors like banks, credit unions and hedge funds," Braeger said. "For the first time, you are the bank and you earn the interest."

Credit unions have been traditionally conservative and based on daily conversations with executives, that has not changed at all, said Eddie Nevarez, vice president of business development for the Newport Beach, Calif.-based National Auto Loan Network, which has a partnership with CU Direct.

"Although I think (VroomBank) is unique and may prove to be a big hit for investors and independent dealers, I don't believe credit unions have a new competitor to fear," said Nevarez. "Aggressive credit unions may look to this as a means of investment, but the risk may be too high for the NCUA to sign off on, especially with the pending RBC rule which does not favor the credit unions with this type of risk on investing." He said VroomBank targets subprime business and 99% of credit unions typically avoid this business like the plague, unless they're involved in efforts such as the NCUF/Filene non-prime auto loan pilot subprime program.

On its website, VroomBank said the notes do involve a certain degree of risk and are considered speculative because the payments depend primarily on payments to BAF's group of consumer finance obligations of individual borrowers and contemporaneous payments on the notes. For that reason, only investors with $200,000 of annual income per individual, $300,000 per couple or a net worth of more than $1 million are eligible to invest in VroomBank. According to the company, the income and net worth thresholds are in line with SEC requirements.

In October 2013, the SEC voted unanimously to propose rules that would permit companies to offer and sell securities through crowdfunding. Under the proposal, a company would be able to raise a maximum aggregate amount of $1 million through crowdfunding offerings in a 12-month period.

Several of the nation's major car manufacturers have also engaged in crowdfunding. For instance, by registering with a third party, Hyundai offers a bonus for those who take part by matching dollar for dollar up to $500 for the down payment on one of its vehicles. Chrysler allows people to pay for features on new Dodge Darts – think family members raising money to pay for a new high school or a college graduate's accessory kit.

Other sites such as Groopid.com permit groups to buy bid passes in new car auctions, according to the online company. While one of the bidders ultimately ends up with the car, the unsuccessful still get a rebate or voucher for use at restaurants and such.

Another company, Members Private Sale, enables members to buy and sell their cars at the private sale price within a peer to peer membership sponsored by their credit unions, said Steven Keys, president/CEO of MPS in Austin, Texas. The service is free for buyers and sellers who transact at the preferred, private sale price and the credit union captures the loan.

Keys said he is skeptical about certain parts of VroomBank.

"Although it provides accredited investors an opportunity to put their money to work, I would be concerned over investing money essentially earmarked for subprime borrowers without any insurance premium on the loan," said Keys. "Credit unions have the ability to lend their members, both prime and subprime, extremely competitive rates and sell ancillary products like GAP, extended warranty at a significantly reduced price than what the members would pay through a dealer."

The $68 million Space City Credit Union was the first to offer MPS 2.0 to its members, said Craig Rohden, president/CEO of the cooperative in Houston.

"Another advantage of MPS is selling our repos to our members, and hopefully, other credit union members, so we don't have to sell those cars at auction," said Rohden. "It only takes a couple of poor showings at the auction to really devalue your auto loan portfolio. If we can clean them and sell them at retail, we save thousands of dollars per vehicle."

Rohden said VroomBank's investor rules would take some of Space City's members out of the eligibility pool.

"VroomBank is an investment platform for people who make more than $200,000 per year individually, or $300,000 per couple," he noted. "Not many of our members qualify for VroomBank investing. However, some do, and they are a competitor. Credit unions should keep their eye on any competitor in the marketplace."

Meanwhile, Braeger said VroomBank has investments coming in from hedge funds and it has raised $5.4 million. Negotiations are in place with one of the country's largest peer to peer lenders that want to get into the auto space, he added. BAF has been in business since 2012 and VroomBank's website launched in February.

As an alternative to banks and credit unions, Braegar said for both, the dealers that have their own credit facility are having a difficult time getting funding, if they even can.

"Therefore, they love our model. Furthermore, we go to the dealers' credit facilities and don't ask to replace the whole credit facility," Braeger explained. "We want to grow with the dealer so we will give them tranches of $1 million or in that range at a time. Therefore, we grow with them."

Bret Weekes, president/CEO of eDoc Innovations, a processing CUSO, said VroomBank won't be a concern."I don't believe there is a new competitor (here), rather, a shift in the competitive landscape that has always existed through large banks, hedge funds and finance companies."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.