No other product has come under scrutiny within the credit union industry as much as payday loans.

No other product has come under scrutiny within the credit union industry as much as payday loans.

While there are internal and external critics who staunchly believe the payday lending model goes against the tenets of credit unions, some may wonder if the way cooperatives are managed may determine if the controversial loan products can effectively help those who are unbanked or underserved.

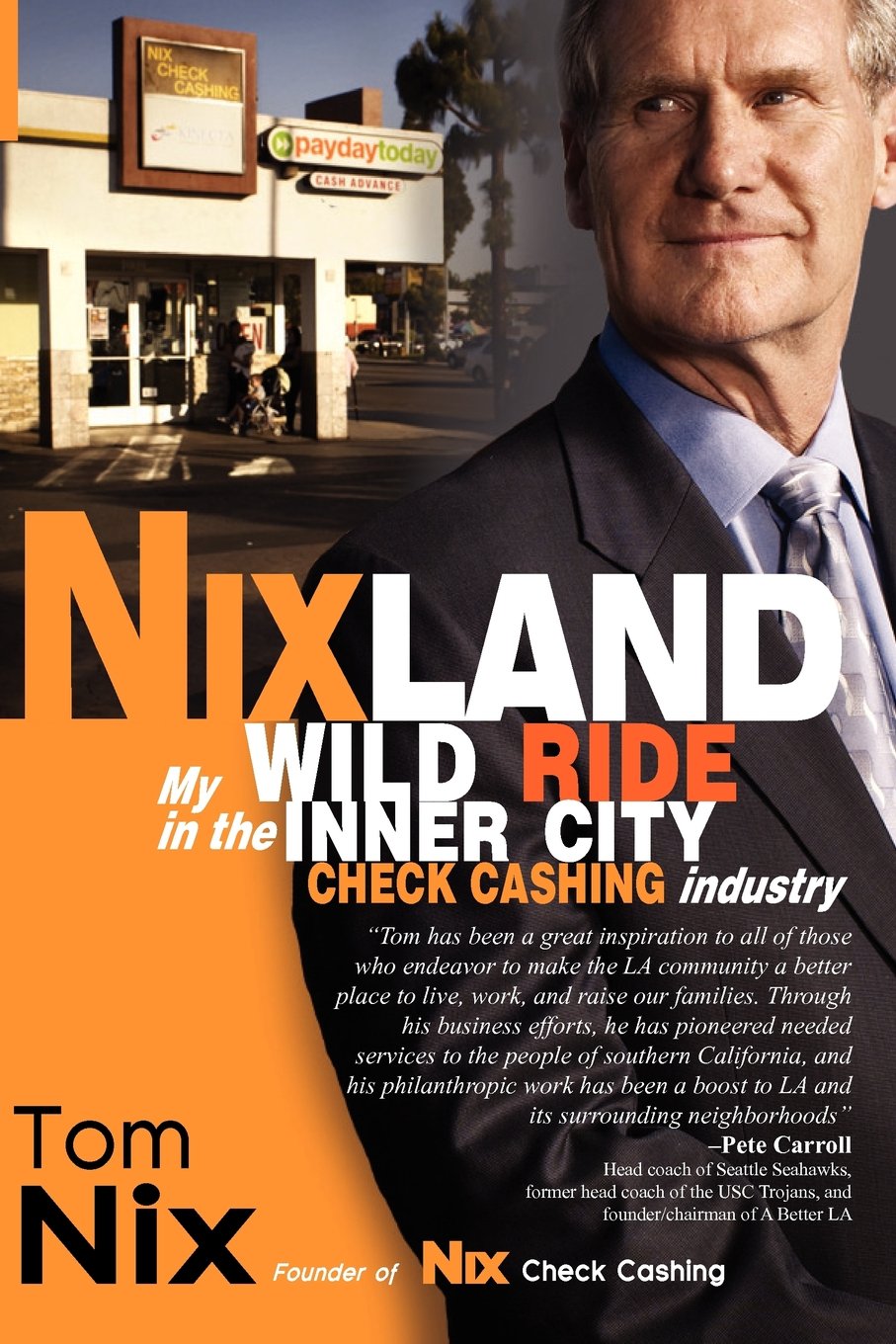

Tom Nix, the founder of what was previously known as Nix Check Cashing, recently released Nixland, an autobiography that includes a chapter on how he negotiated the $45 million sale of his business to the $3.1 billion Kinecta Federal Credit Union in Manhattan Beach, Calif., in 2007.

Nix questioned whether a certain type of leadership template is needed to produce success in the payday lending space.

“Kinecta had a centralized form of management that was in stark contrast to my management style,” Nix wrote in his book. “They believed in Matrix Management and from my point of view, got very poor results due to the lack of well-defined responsibility and accountability.”

When Nix sold Nix Financial to Kinecta, he stayed on and became the new subsidiary's division president for more than a year, but said the role did not work out well. In his book, he wrote he was accustomed to a decentralized approach to managing the business, giving his entire management team the responsibility and authority to manage their respective departments and holding them accountable for results.

Nix said instead of second-guessing managers’ mistakes, the missteps were seen as learning opportunities. As a result, managers were highly motivated and strove for excellence.

The same wasn't true at Kinecta.

“There was a lack of respect for the chain of command, and the committee form of management undermined it,” Nix wrote.

Frustrated, Nix resigned in July 2009 after serving as a part-time adviser to Simone Lagomarsino, then president/CEO of Kinecta, and the new division president.

When contacted by CU Times, Kinecta chose not to be interviewed for this story.

“However, we would like to contact you soon because we would like talk to you about (Nix Financial) and our plans for the near future and where we see this industry going,” said Marsha Mathias, Kinecta vice president of corporate communications.

For years, credit unions and CUSOs have been attacked for offering payday loans. One of the more recent hits came last summer when both the National Consumer Law Center and the Center for Responsible Lending called out nine credit unions for offering payday loans to members at what the groups described as exorbitant interest rates. Their May 2013 letter to the NCUA prompted an investigation to ensure credit unions and CUSOs were operating within regulatory parameters.

Among those targeted by the NCLC and CRL was Kinecta and Nix Financial, which was criticized for what the organizations deemed were high rates and exorbitant fees.

When the Nix Check Cashing name was changed to Nix Financial in July 2011 to reflect a wider array of consumer financial products and services offered by Kinecta, the new moniker was not embraced by the store's customers, according to the payday subsidiary's website.

Just this year, the name was changed again to Nix Neighborhood Lending to position the company as a neighborhood financial organization committed to building the communities it serves, the site read. There are now full-service Kinecta ATMs at 31 locations and over-the- counter credit union services and select deposit products at 10 locations. Nix has 38 service centers in Los Angeles County, one in San Bernardino County and one in Orange County.

Meanwhile, rather than question whether the management structure is a factor in determining if a credit union can successfully offer payday loans to the underbanked, credit unions should focus on more important issues, according to some advocates.

For instance, a credit union and its employees must have experience with payday type products, said Asa Groves, COO at XtraCash LLC, a payday lending subsidiary of CU Holding Co. LLC, which is owned by the $471 million Mazuma Credit Union in Kansas City, Mo. XtraCash has been targeted by consumer financial watchdogs.

“Questions a credit union must answer in making that decision include how much risk is the credit union willing to take,” Groves said. “What are the core system challenges with this type of product (and) what are the regulatory challenges with a product with very high defaults?”

Historically, XtraCash has added new credit union partnerships every year; however, as a result of the recent position of NCUA, the CUSO lost all of its partners with a federal credit union charter, Groves said.

“Even with that loss in partnerships, XtraCash experienced an increase in loan volume of nearly 25%, which proves you can regulate away the product but the need remains,” he said.

Groves said as expected, borrowers of the XtraCash products have much higher default rates than what credit unions experience, thus the reason for the higher cost.

But the CUSO has found that there is a loyalty with members and their credit unions that has resulted in fewer defaults than the national average, he added.

In his book, Nix said when he closed the Nix Financial deal with Kinecta on Aug. 14, 2007, he realized his dream of selling his company to what he called a strategic buyer who would share his mission, care for the employees and fill the banking needs of underserved communities. Most of Nix Financial's 450 employees got raises and better benefits after the acquisition, according to Nix. However, there were a few roadblocks along the way.

“There were a tremendous number of issues, many of them driven by government regulations required by the NCUA,” Nix wrote. “Everyone associated with the integration worked extremely hard to make it happen in a positive way.”

Meanwhile, the $34 million 1st Valley Credit Union in San Bernardino, Calif., has offered a payday loan alternative since 2009, said Gregg Stockdale, president/CEO. Through its Assist Member Program, members have decreased their overdraft fees by $133,000, netted a savings of $116,000 in fees and amassed $33,000 in savings. The credit union puts 10% of each loan amount in a separate savings account so members can track how much they’re accumulating.

Stockdale said he does not believe a credit union's management model matters when it comes to offering a payday loan or alternative product.

“We approve the member for the program, not each advance. It's based upon the relationship with the member and their amount of deposit history,” he explained. “If I were a bank, I’d be bemoaning the loss of the $116,000 of income or I’d kill the program. But, thankfully for our members, we are not a bank.”

At its Jan. 23 meeting, the NCUA Board voted to extend the current interest rate cap of 18% for most federal credit union loans through Sept. 10, 2015. “(That) enables them to offer payday loan alternatives so members are not dependent on predatory lenders to meet their short-term cash needs,” NCUA Chairman Debbie Matz said then.

In his book, Nix said part of the plan was to add Kinecta's financial services to each of Nix Financial's stores so that those living or working in the surrounding communities could become members of the credit union.

“We also hoped to attract people who were already banking at another institution by offering branches that were more conveniently located inside the inner city,” Nix said.

When CU Times contacted Nix, his publicist said he is in the process of rewriting the book and declined an interview request. The new edition is expected to be completed later this year.

“We’re not revamping because (the) information was incorrect,” the publicist said. “This is his story, this is his journey. It in no way speaks of how Kinecta is running the business today. We’re making no statements on Kinecta's current status.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.