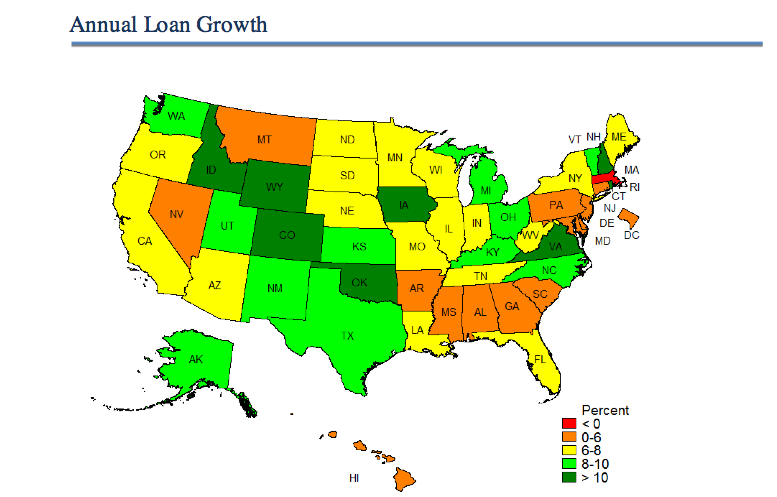

Idaho, Iowa and Virginia posted the largest gain in loan growth at credit unions in the year ending Dec. 31, 2013, according to the NCUA's Quarterly U.S. Map Review.

Idaho, Iowa and Virginia posted the largest gain in loan growth at credit unions in the year ending Dec. 31, 2013, according to the NCUA's Quarterly U.S. Map Review.

Idaho also topped the list in the membership, total assets and shares and deposit growth categories.

“Nationally, total loans outstanding grew 8.0% in the year ending in the fourth quarter of 2013, up from 4.6% the previous year. Loans grew in all states except Massachusetts, which saw a decline of 0.1%. Idaho (16.7%), followed by Iowa and Virginia (both 13.6%), posted the largest gains,” said an NCUA release on Wednesday.

While membership overall in federally insured credit unions increased 2.6% to 96.3 million in 2013, membership grew at a faster pace in 27 states. Credit unions in Idaho (8.1%) and Virginia (8.0%) saw the fastest membership growth. Membership dropped in eight states including Connecticut, which saw the greatest loss at 1.5%.

Utah had the highest return on average assets with 145 basis points, and Washington came in second with 116 basis points.

Federally insured credit unions in Idaho and Iowa had the quickest growth in total assets for 2013.

“The delinquency rate at federally insured credit unions was 1.0% nationally in 2013, a decline from 1.2% the year before. Delaware and New Jersey posted the highest total delinquency rates, while North Dakota and New Hampshire had the lowest,” the NCUA also said.

Shares and deposits increased 3.7% nationally, with Idaho posting the largest gain. In 2012, shares and deposits rose 6.1%. The NCUA said shares and deposits fell in Massachusetts and Maryland mainly due to the conversion of a large credit union to a bank.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.