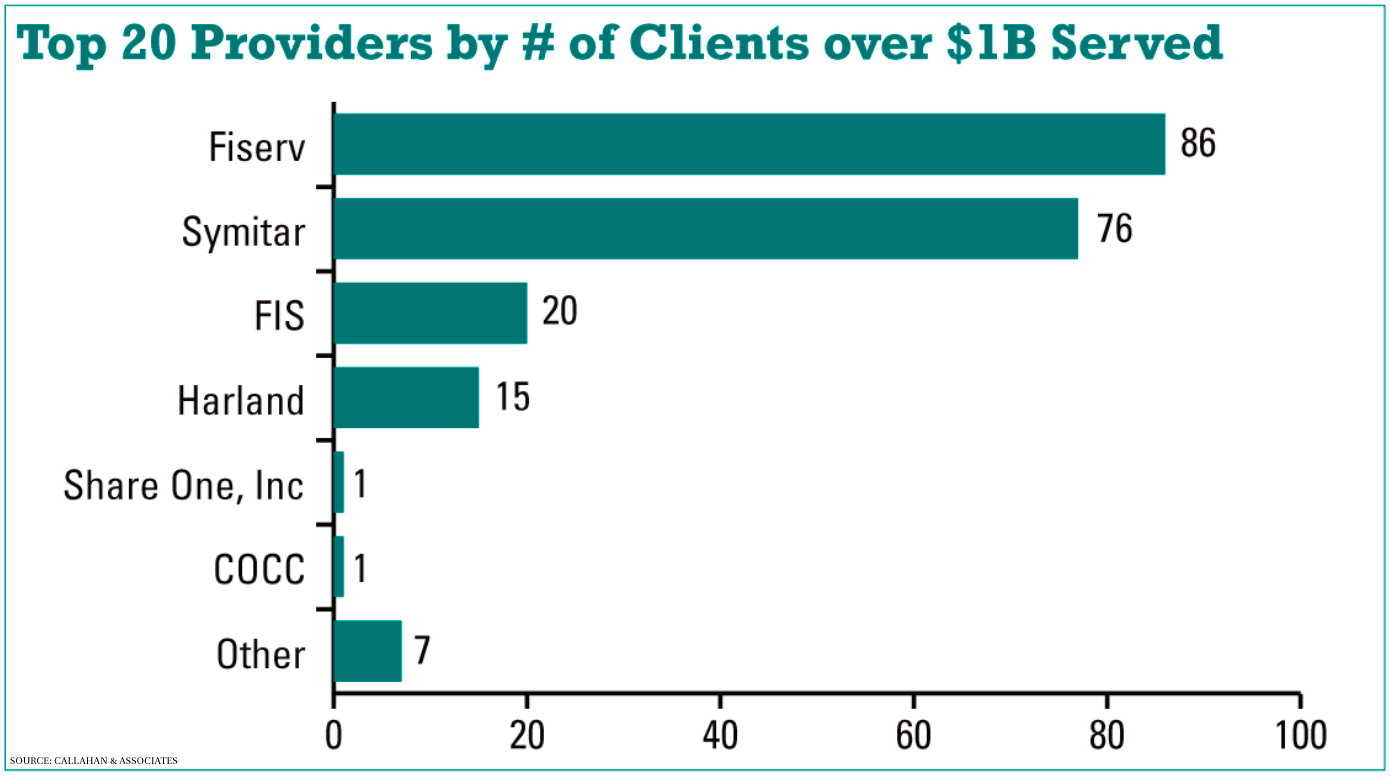

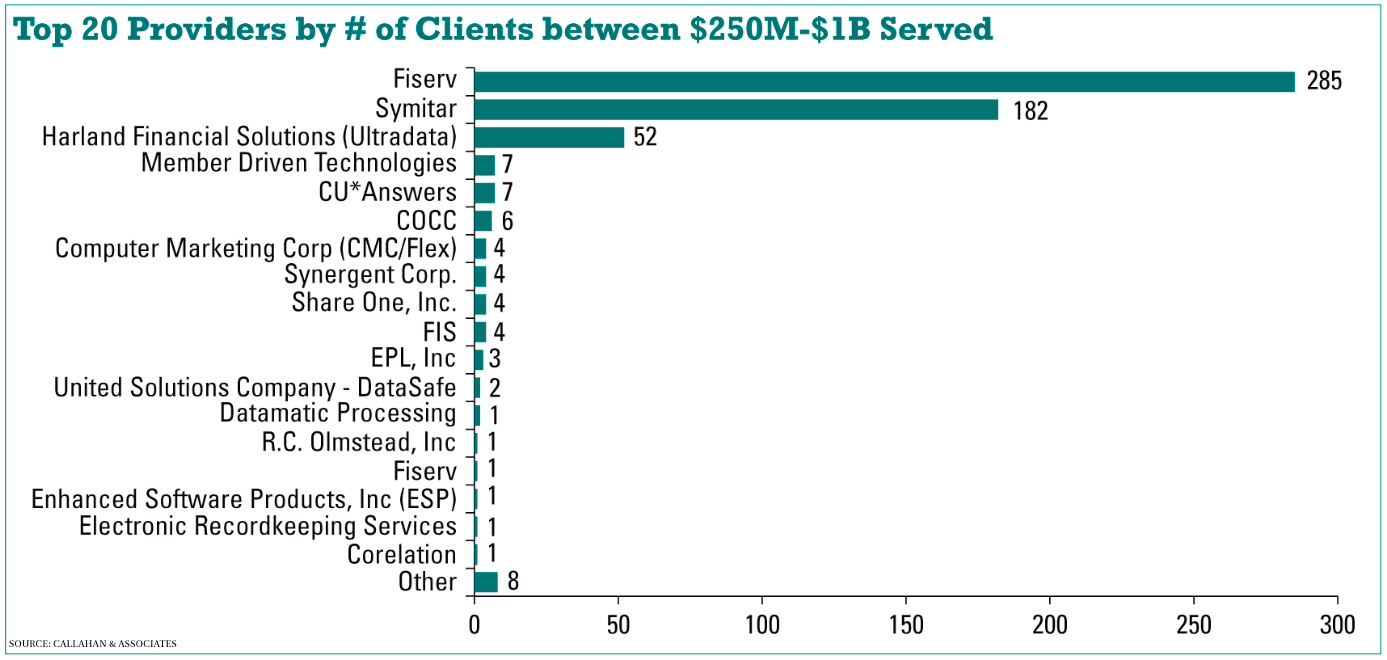

Fiserv and Symitar, a division of Jack Henry & Associates, dominate the core processing business for credit unions, and these graphics from Callahan & Associates show just how much. (Click on each graph to enlarge.)

Fiserv and Symitar, a division of Jack Henry & Associates, dominate the core processing business for credit unions, and these graphics from Callahan & Associates show just how much. (Click on each graph to enlarge.)

According to Callahan’s 2014 Market Share Guide/Credit Union Core Processing, Fiserv, which built its business through two decades of acquisitions before consolidating its credit union divisions a couple years ago and then buying Open Solutions last year, has the lion’s share of the market overall, providing core processing services to about 2,400 of the nation’s 7,000 or so credit unions.

Symitar has a big footprint, too, especially among larger credit unions, with more than 500 on its flagship Episys platform and another 170 running the Cruise solution for smaller credit unions.

Meanwhile, among the smallest asset class, FedComp still comes in second behind Fiserv, serving more than 800 credit unions, although consolidations and closings have helped cut its client list that once numbered around 2,000.

According to Callahan, CUSOs still maintain a solid niche in the core processing market, including those that run their own platforms, such as CU*Answers, EPL and Share One, and others that serve as service bureaus for Symitar customers (Member Driven Technologies), Fiserv DNA users (COCC) and CU*Answers (CU*South and CU*Northwest).

Other ownership structures exist in the space, including at Synergent, a Maine league-owned Symitar service bureau, and Minnesota-based Sharetec Systems, which claims nearly 300 customers on its platform and is owned by four regional distributors across the country.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.