Although CD rates have dipped slightly from this time last year, credit unions continue to offer the best CD rates in the U.S., according to a recent survey by GoBankingRates.com.

Although CD rates have dipped slightly from this time last year, credit unions continue to offer the best CD rates in the U.S., according to a recent survey by GoBankingRates.com.

(Click image at left to expand.)

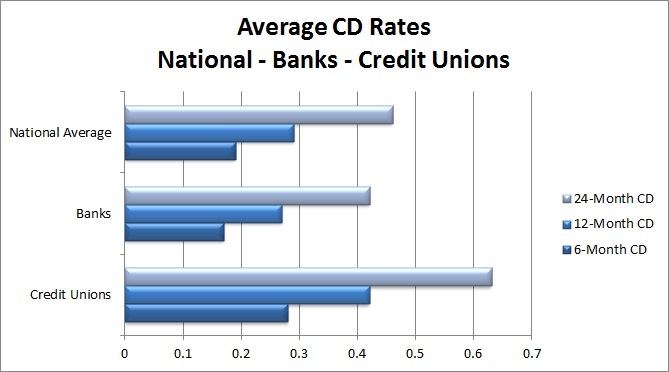

The average rates for a six-month CD at credit unions have dropped from .31% in 2012 to .28% this year, while bank rates for a six-month CD have shifted from .21% last year to .17% in 2013, said the Los Angeles-based personal finance website.

The current average rates for a 12-month CD are .47% at credit unions and .27% at banks, and rates for 24-month CDs are averaging .69% at credit unions compared to 42% at banks.

Credit unions have consistently trumped banks on CD rates in recent years, said Amanda Garcia, personal finance writer with GoBankingRates.com.

“Since credit unions are considered not-for-profit financial institutions, it's not surprising that they would offer better interest rates on deposit accounts than banks,” Garcia added.

According to the recent GoBankingRates survey, which cited rates as of Dec. 11, credit unions provide a majority of the best CD rates with these six co-ops included in the top 10 list of best CD rates for December:

- The $528 million Westmark Credit Union in Idaho Falls, Idaho., 24-Month CD 1.51% APY,

- The $402 million America's Credit Union in Ft. Lewis, Wash., 12-Month CD 1.51% APY

- The $16 billion Pentagon Federal Credit Union in Alexandria, Va.,24-Month CD 1.41% APY,

- The $355 million Kauai Community Federal Credit Union in Lihue, Hawaii, 24-Month CD 1.40% APY,

- The $375 million Members Cooperative Credit Union in Cloquet, Minn., 24-Month CD 1.40% APY; and

- The $1.5 billion Idaho Central Federal Credit Union in Chubbuck, Idaho, 24-Month CD 1.31% APY.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.