The financial analysis and consulting firm SNL Financial has released a report showing banks nationwide shut 390 branches in this year's third quarter, furthering a year-long trend.

The financial analysis and consulting firm SNL Financial has released a report showing banks nationwide shut 390 branches in this year's third quarter, furthering a year-long trend.

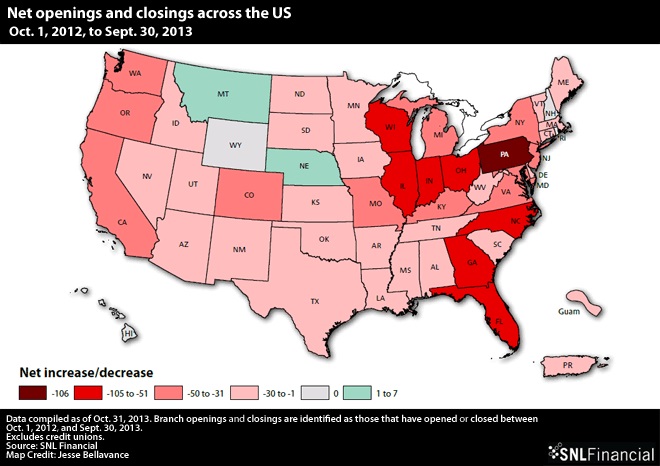

According to the firm's data, banks have closed a net 1,343 branches since the fourth quarter of 2012, with the firm citing the shift to more mobile and online transactions and the increase in bank mergers for the trend.

(Click on image at left to expand.)

Recommended For You

According to the report released this week, 45 states have lost bank branches since Oct. 1 of last year, as well as Guam and Puerto Rico. Hawaii was shown not to have gained or lost any branches and Alaska was not mentioned in the report. Montana and Nebraska gained branches.

The states that lost the most bank branches were Pennsylvania (106), Florida (79) and Indiana (77).

The report did not reiterate the frequently heard prediction that bank branches would vanish as a transaction and business channel, but did suggest that they would continue to evolve in places where loan and other types of transactions became more likely.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.