It may not be the first iPad app issued by a credit union, but Navy Federal's new iPad app – released Monday – is intended to be a from-the-ground-up revisiting of what the nation's largest credit union's members want from a tablet app, said assistant vice president for eChannels Meghan Gound.

The $54 billion Navy started work on the app about 18 months ago, said Gound, who stressed, “We do our development in-house.” That work sometimes involved a project management team of as many as 60, she said, but in Navy's views, the stakes are large: “This is about reinforcing our connections with our members. We wanted an app that is useful and convenient,” said Gound.

Many dozens of credit unions already have iPad apps in Apple's App Store but many of those are in effect simply slightly modified and enlarged iPhone apps. The Navy Federal app is different, Gound said.

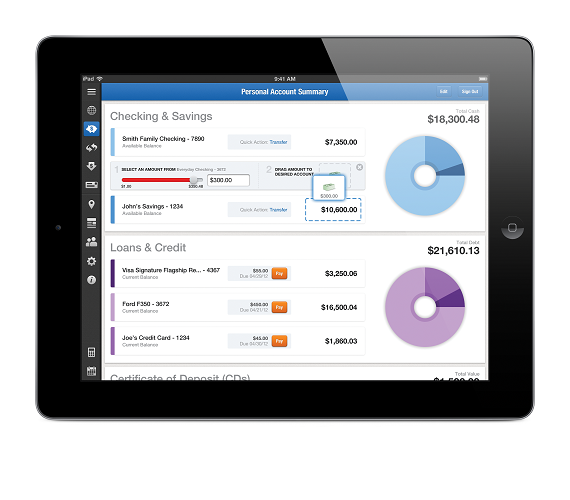

“We have built in substantial content and features,” said Gound, and the point is to take advantage of the comparatively large screen.

Case in point: Navy Federal's YouTube videos are viewable within the app. So are the institution's social media streams as well as a Navy Federal blog. “We have also brought in financial education information,” said Gound who added that “there just is a lot more functionality in this app. We have improved upon everything because people spend a lot more time in sessions on their iPad.”

That is important, she explained, because in less than four years (Navy introduced its first app in 2010), “we have watched our mobile traffic really take off. Mobile is now 67% of our online volume and it is continuing to grow,” said Gound.

Around one million Navy Federal members (out of a total of 4.3 million for the Virginia-based credit union) are active users, said Gound.

She added, “We have watched our tablet traffic in particular keep growing. iPad traffic is 22 to 25% of our total mobile traffic.”

Presently, said Gound, the institution does not see sufficient Android tablet traffic to warrant a dedicated app, but it monitors the numbers and “when we see the traffic we will be prepared to move very quickly.”

In the first version of Navy's iPad app, members will be unable to file loan applications and they also cannot add new payees to bill payment, but “that may come. We have plans to introduce new functionality in a future release,” said Gound.

As for marketing the app, Navy will announce its availability on social media, also at branches, and, said Gound, the institution anticipates fast adoption. “An iPad app has been one of things most requested by our members.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.