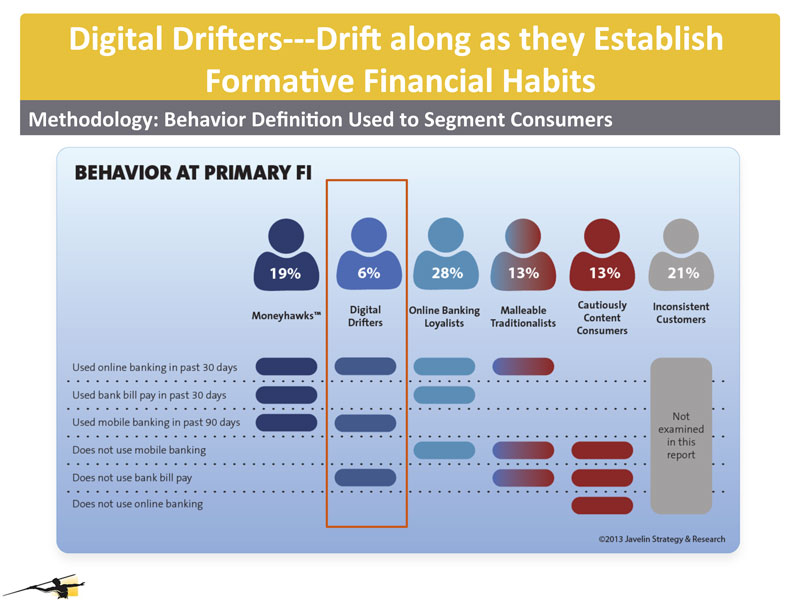

The report from Javelin Strategy + Research could not be more ominous. Financial institutions, credit unions included, have dropped the ball with a huge market segment that simply overlooks them when it comes to digital bill pay.

Noted the Javelin report titled “2013 Online Banking and Bill Payment Forecast:” (Bill pay) adoption will remain unacceptably at through 2018 unless nancial institutions take action to upgrade services, counter misperceptions about paying bills at FIs, and specically target 29 million Americans who are only one step away from paying bills at their bank or credit union.

“The priority list of holdouts is topped by a newly identified segment of nearly 11 million Digital Drifters, dened as consumers who bank online and use mobile banking but do not pay bills at their primary FI,” the report said.

Mark Schwanhausser, director, Omnichannel Financial Services, at Javelin, said in an interview, however, that there are reasons for optimism. “If financial institutions do this right, they could add 29 million people as customers using bill pay.”

Mark Schwanhausser, director, Omnichannel Financial Services, at Javelin, said in an interview, however, that there are reasons for optimism. “If financial institutions do this right, they could add 29 million people as customers using bill pay.”

(Click on image above to see enlarged version.)

What is intriguing about the 11 million Digital Drifters in particular is that while they do not pay bills using their financial institution's digital tools, they do however pay bills at biller websites. At least 70% of them do, according to Javelin.

Javelin's analysis of that behavior poses both an opportunity and a challenge to credit unions. The report noted: “Javelin's analysis concludes these are generally younger, impressionable digital-minded consumers who could 'drift' into paying bills at their primary bank or credit union if offered a more compelling alternative.”

That, suggested Schwanhausser, is the big if. Is the alternative “more compelling?”

“It's not about marketing better. It's about improving your products,” said Schwanhausser.

Right now, these digital drifters say “financial institution bill pay is inferior,” said Schwanhausser.

As for the cure, Schwanhausser asked, “You need to offer tools that will satisfy them, especially mobile tools. They all have smartphones. This clock is ticking.”

“Your challenge,” said Schwanhausser, “is moving fast enough.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking credit union news and analysis, on-site and via our newsletters and custom alerts

- Weekly Shared Accounts podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the commercial real estate and financial advisory markets on our other ALM sites, GlobeSt.com and ThinkAdvisor.com

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.