Searching for ways to improve member service, speed up the loan process and comply with multi-featured, open-ended lending regulations, many credit unions have found a solution in remote signing technology.

Searching for ways to improve member service, speed up the loan process and comply with multi-featured, open-ended lending regulations, many credit unions have found a solution in remote signing technology.

And, experts say the approval of the E-SIGN Act of 2000, along with improvements in mobile banking and cloud-based computing, have made e-signature solutions economically viable for credit unions of all sizes.

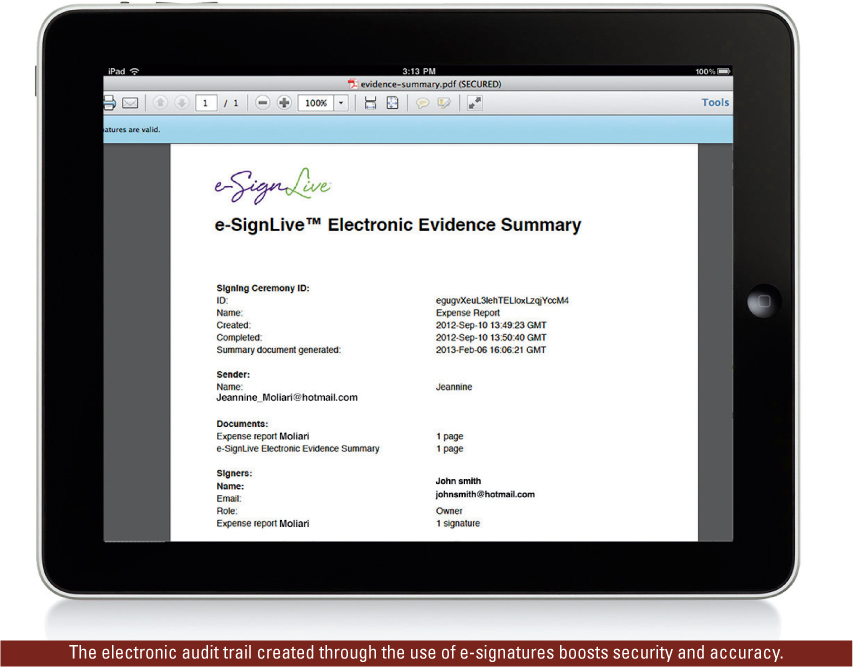

In addition to reducing paper use and costs, the use of e-signatures provides an electronic audit trail for each step, which boosts security and accuracy.

Recommended For You

E-signatures can help credit unions cut through the MFOEL red tape and keep the balance sheets out of the red, said Tommy Petrogiannis, CEO of Silanis, a Montreal-based technology firm that said it processes more than 600 million documents annually using on-premise, cloud and SaaS e-signature solutions.

"Asking members to come into a branch every time their signature is needed can create a real inconvenience and is also inefficient, but e-signatures remove those obstacles," he said. "By implementing e-signatures—whether through on-premise or cloud-based platforms—credit unions can cut enhance customer service, improve operational efficiency and accuracy, and increase loan revenue."

Leveraging remote signing technology can help credit unions clear regulatory and risk management hurdles, and compete against large banks by extending service without building new branches. It also attracts younger members drawn to mobile banking, he said.

"Most loan transactions today begin in an electronic format—whether it's a loan officer entering information at a branch or a member applying online, but then the automation chain is broken when it comes time for the signature. Suddenly paperwork is being printed out, shipped out and the clock starts ticking for the moment when the paperwork is returned, scanned and entered into the system," Petrogiannis added. "All of that adds up to serious costs for credit unions. On the other hand, e-signed documents automatically flow into the organization's document management system for better accessibility."

When adopting e-signature solutions, there's a trend among credit unions, according to Silanis.

"Starting small to go big seems to be the motto lately among credit unions adopting e-signature and cloud-based computing solutions," Petrogiannis said. "A lot of times, the credit union wants to keep some services on premises at first and put part of them in the cloud. Then they can gradually migrate more to the cloud as the need arises."

For example, the $1 billion Sharonview Federal Credit Union recently announced that it is adding e-signatures to its mortgage disclosure process.

The 65,000-member credit union in Fort Mill, S.C., plans to implement Silanis' on-premise e-signing software, the credit union said.

"E-signatures make sense for us not only from a competitive standpoint, but also to help us meet compliance requirements like the 48-hour window to deliver mortgage disclosures; for that reason we'll be investing additionally to automate mortgage and other processes including member applications," said Mark Johnson, Sharonview's chief information officer.

Johnson said Silanis' on-premise e-signature solution fits Sharonview's policy that discourages storing member data on the cloud. He said Silanis was able to deliver an affordable, in-house solution that meshed with the credit union's internal policy and integrated with other automated systems.

Remote signing technology also reduces labor and costs associated with printing, scanning, shipping and processing documents, which saves the credit union time and money, he said.

Next Page: Productivity Increases

Productivity has also increased at the $6 million Teachers Credit Union in Ontario, Canada, since it implemented the Silanis e-SignLive solution with a pilot in the fall of 2012 and the full roll-out in January 2013.

"Providing the ability for our members, who are disbursed across a wide geographic area, to sign documents from anywhere creates an edge that allows us to compete with larger financial institutions," said Kathy Clark, vice president of sales, service and operations with the 15,000-member credit union.

Loan applications are completed either through a call center or online. TCU staff use templates set up on the Silanis e-SignLive solution to easily and accurately identify where a signer needs to electronically sign or initial, Clark said.

Since the system rejects documents that are incomplete, Clark said, such applications have become virtually non-existent, resulting in improved efficiency and member satisfaction.

Member service was the main motivation for adopting an electronic signature solution, Clark said, but the credit union also wanted to bolster security.

"Members care about security and convenience," she added.

To ensure security, Clark said, TCU required that the e-signature solution digitally sign each document and capture the entire signing process, including every web page and action that a member and staff take.

"From a regulatory perspective, should we ever need to collect on a loan document, we wanted it to be able to stand up in court," she explained. "Personal information verification would need to be achieved via self-identification and third party identification."

Like many credit unions investing in new technology, TCU wanted to start small, Clark said, and the credit union plans to roll out e-signatures to branches, call centers and other customer-facing channels as needed.

"For us, it's about delivering better service, not cost/time savings," added Clark. "Offering the ability to use e-signatures is all about providing better service while making sure everything is compliant to regulations."

Petrogiannis said that some lenders using the Silanis e-signature solution have reported significant return on investment. For instance, he said, since adopting esignatures, one mortgage provider reported that a more than 100% revenue increase, an 85% reduction in shipping costs, application processing time reduced from seven to 10 days to just 48 hours, and loans closed in fewer than 25 days.

The results are applicable to credit unions looking for technology that increases service, productivity and profits, he said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.