The lending environment is undergoing an evolution. The continual entry of new players—especially on the Internet—has sharpened competitive knives that are cutting into credit union income. Business loans are an avenue for lenders to travel, since non-interest income is becoming so critical to survival.

The lending environment is undergoing an evolution. The continual entry of new players—especially on the Internet—has sharpened competitive knives that are cutting into credit union income. Business loans are an avenue for lenders to travel, since non-interest income is becoming so critical to survival.

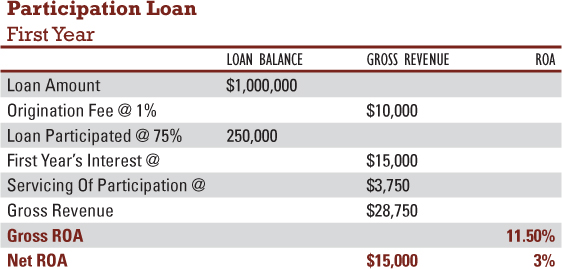

The following three examples show how auto, participation and SBA 7a loans add to an organization's revenue stream during the first year. The table shows a the traditional auto loan—the bread and butter of the credit union portfolio—has become more competitive as captive finance companies have the advantage of being at the point of sale. And there is little opportunity for noninterest income, unless other products are sold with the auto loan. An aggregate loan of $1 million earns a gross ROA of 2.99% for the first year. After expenses of underwriting, servicing, systems and staff the loan earns an estimated net ROA of 75 basis points.

Participation loans are a welcome addition to the portfolio for a number of reasons. For starters, they include origination and servicing fees. There is currently an oversupply of buyers for participation loans, but also an underdeveloped market of loan originators. Noninterest income could represents 48% of total income on such a loan.

One of the unsung benefits of participation loans is that the participated portion of the loan doesn't count towards the 12.25% cap. This restrictive regulation is a drag on business lending growth. Legislative efforts to unharness the cap have stalled. Participation loans can help alleviate the effects of the cap.

Credit unions typically follow two strategies with business lending. Lend and hold emphasizes interest income—not fee income—and can result in the illusion of a higher-yielding loan portfolio due to a high loan-to-share ratio. This old school belief maintains that more loans on the books translate into a higher loan-to-share ratio, which equals more revenue. The loan-to-share ratio, though, doesn't show the speed and turn of the profit being earned. Interest income is time-based and is restricted, while fee income isn't.

The lend and sell strategy emphasizes noninterest or fee income. The loan that generates the highest level of non-interest income is the highest driver of increasing ROA. The more loans that are sold and fees earned, the more profits generated and the lower the cost of funds. To increase ROA and capital accumulation, a lend and sell strategy is the best choice.

The first year of a participation loan with an origination fee of 1%, interest income of 6% on the portion of the loan that wasn't participated out, and the servicing fee of participation at 50 basis points. The gross ROA after the first year of the participation loan is 11.50%, and after expenses, earns an estimated 3% net ROA.

SBA loans offer a number of benefits to business lenders, including the potential for a higher ROA and fee income. And like participation loans, the guaranteed portion of the loan doesn't count toward the cap.

On such a loan, 75% of the $1 million loan was sold on the secondary market. The first year's interest on the unguaranteed portion of the loan and loan servicing brings the gross revenue to $97,500. The gross ROA is 39%. After expenses, the net ROA is 5%.

The economy is still in recovery while the lending market continues to limp along. Participation and SBA 7a loans are ways for credit unions to increase fee income and ROA while assisting small businesses, their local markets and the national economy.

Kent Moon is president/CEO of Member Business Lending LLC in West Jordan, Utah.

Contact

801-230-1044 [email protected]

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.