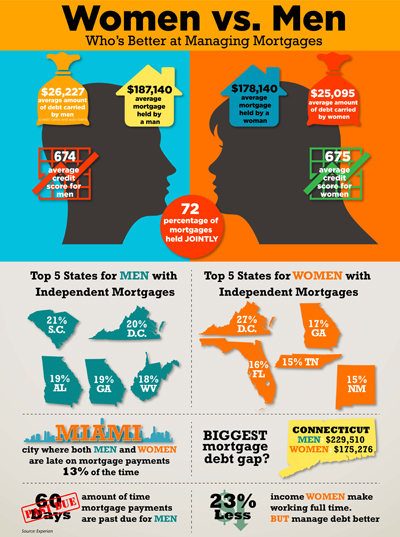

When it comes to managing their mortgages and paying down debt, women may have an edge over men in some areas.

For the first time, Experian said it analyzed credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. The company discovered women have a slight advantage with their credit scores and the average amount of debt that they carry.

The following info graphic highlights some of Experian's findings as well as which states rank highest in terms of where women and men have the most independent mortgages.

Read More in This Week's Lending Focus Report:

- Will Purchase Loan Shift Create Real Estate Earthquake?

- Mortgage Lenders May Be Heading for Rough Seas

(Click on the chart at right to see an expanded version.)

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.