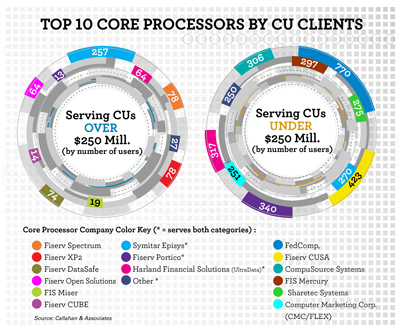

Fiserv and Symitar dominate the discussions around credit union core systems, but many smaller providers are nipping at the heels of the core giants.

Part 1 of this series detailed the players in the field.

Here, part 2 looks at how the niche players are positioning their offerings.

Probably the single biggest problem facing core system providers that aren't Fiserv or Symitar is that, for them, the struggle is to seem part of the 21st century conversation. Core systems, in their guts, generally are over 20 years of age–frequently much older–so this is a mature IT solution that has been commoditized.

Where there is profit to be made it is in the add-ons, the plug-ins that upgrade the core, said Tom Berdan, a vice president at Lake Mary, Fla.-based Harland Financial Solutions, who oversees the company's core systems, PhoenixEFE and UltraData, which are found in around 385 credit unions, generally institutions with under $250 million in assets.

Where there is profit to be made it is in the add-ons, the plug-ins that upgrade the core, said Tom Berdan, a vice president at Lake Mary, Fla.-based Harland Financial Solutions, who oversees the company's core systems, PhoenixEFE and UltraData, which are found in around 385 credit unions, generally institutions with under $250 million in assets.

(Click on image at left to expand.)

At Harland, Berdan said there is a considerable push to stand out by tweaking its cores to do a good job of detecting anomalous behavior in a member account that may be linked to crime such as elder fraud or account takeover.

He said that these kinds of frauds are becoming an ever bigger concern to credit union executives and regulators, and he suspects the volume of such criminal activity will shoot up as EMV implementation in 2015 prompts fraudsters to seek out new vulnerabilities. In his mind, the Harland core can become a part of the solution and that he believes may win credit union customers.

FIS is a huge financial tech company. “We do business with 85% of credit unions,” said Jerry Nissen, a vice president. But it is an also ran in cores with around 308 credit unions customers, mainly smaller institutions, according to Callahan. The company wants to change that and, per Nissen, it feels it may have a timely card to play in its Miser core, mainly aimed at institutions bigger than $250 million. That's because Miser has its roots in the banking world and integral to its structure are strengths in managing business lending.

“Our challenge is market awareness. What we have been doing is a lot of innovation–channel integration and tight integration with mobile, online, e-wallets,” Nissen said. “Miser is unique, it is very powerful. We still have a large presence in banking. We have one institution that is $45 billion running on it.”

Nissen, incidentally, also said FIS has been upgrading its Mercury core, aimed at smaller credit unions. “We have been adding functionality,” said Nissen, who acknowledged that thus far FIS is not seeing a boost in traction among credit unions, meaning new adoptions are thin.

UltraData, Miser, Mercury–these are well-proven cores. That is not the so at Corelation. There, the question on prospects' minds is, Is it really going to work? That, said Theresa Benavidez, was the constant refrain from prospects in the early months of Corelation, the San Diego-based developer of one of the industry's few truly new core systems.

Benavidez serves as president of the company and, she said, Corelation now has 14 credit unions under contract. “Credit unions come to us because they want a core provider where they are heard. They don't want to be told which add-on modules they need to buy. They want their credit union to be important.”

A Corelation plus, per Benavidez, is that it is truly open. Other cores claim openness, she said, but with Corelation the credit union truly calls the shots when it comes to integrating add on services. “A year from now we will have at least five more credit unions on our core. We are growing,” she said.

Immense changes may be in the near-term future for core systems, particularly in smaller credit unions, and this is for two compelling reasons. To survive, most of those institutions will need, and quickly, to offer a fleshed out lineup of banking services right down to mobile remote-deposit capture, real-time person to person payments, mobile banking and the rest of the high tech goodies offered by big banks. Those small institutions also want to pare their costs in operating cores, an expense that more are grumbling about.

The two forces seem contradictory. But they just may be driving sweeping innovation.

At My CU Services, a CUSO owned by Mid -Atlantic Corporate Credit Union in Middletown, Pa., COO Howard Stein said that CUSO “is actively looking at offering core as a service, especially to smaller credit unions.” He defined smaller as under $100 million in assets.

Stein said that in his opinion “there is no question many credit unions are overpaying for their cores. We believe we could drive down the expenses.”

My CU Services, accordingly, is now looking for a core system that it might buy, tweak and build in new tools such as mobile and online banking, said Stein.

Meantime, over at EPL, Senior Vice President David Gibbard ponders the viability of a hosted solution. “That's the trend. To get what they want, credit unions are beginning to move away from in-house solutions.”

The key advantages of hosted solutions, already offered in various flavors by several providers but take up has been slow, is that in effect core is outsourced to the provider who, at all times, can be held accountable for keeping the system running and up to date. Because the system is shared, rather than owned outright, costs may also be lower while functionality is higher.

“For credit unions with under $750 million in assets, it makes more economic sense to do core functions in the cloud, in a hosted environment,” said Gibbard.

How long will it take to transition to a point where most credit unions are in fact in hosted cores? Gibbard shrugged. The average core contract is five to seven years, he said. Every year, perhaps 1,000 credit unions could swap cores. How many will?

“Credit unions that want to survive need to pull their heads out of the sand,” Gibbard said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.