Credit union marketers searching for the best way to reach their members can dig into an overflowing toolbox today, ranging from traditional approaches such as direct mail to new options like Twitter and whatever else is currently “in.”

Credit union marketers searching for the best way to reach their members can dig into an overflowing toolbox today, ranging from traditional approaches such as direct mail to new options like Twitter and whatever else is currently “in.”

That may sound like good news, but it also presents challenges.

“Every week there is something new,” said Brandon Diehl, president of Stratix Marketing in Tampa, Fla. “Most credit union marketers are one-person marketing departments and it’s very difficult to learn all that. People can become overwhelmed.”

“I tell them there are always going to be new media. It’s more important to focus on the principles of marketing than the medium you’re using. Most credit unions really need to build up their call to action. Get very specific.”

Diehl also believes credit union professionals overestimate how much members know about financial services. A marketer may think members should get an auto loan because the credit union offers great rates. But the member simply needs transportation, and is alert to the features of the new Belchfire or Sipsgas rather than loan percentages. Diehl suggests credit unions need to refocus on what the member wants.

“When we talk about auto loans and home loans and other products we know all the curves and twists inside and out. But when you say ‘overdraft’ to a member, they may just look at you with a blank stare,” Diehl warned.

Another challenge is that financial advisers have been cautioning people to pay down debt. Many baby boomers closing in on retirement may never resume the spending level they once enjoyed. Loans? They may tend to pass. At the same time, credit unions are struggling for any kind of revenue they can get.

Thomas “Bo” McDonald, president of Your Marketing Co. in Greenville, S.C., said marketing budgets have been cut as credit union struggle to comply with assessments and regulatory mandates. As the economy has improved over the past couple years, those budgets have improved, but they’re lagging behind levels they were at a few years ago.

At the same time, the number of marketing options has blossomed. The big mistake, McDonald said, is trying to do it all. The result is watering down media buys and trying to dabble in social media. Enough funds aren’t allocated to make an impact.

“I’ve noticed an increase in calls to us recently from credit unions who want to take social media more seriously,” he noted. “There are people who brand themselves as social media experts and I would challenge that. Facebook is changing daily. You’ve got to have somebody who is following that stuff constantly. It’s tough to keep up.”

McDonald said all of his firm’s work is with credit unions under $100 million in assets where the marketing person may also be the CEO or a member of the management team who is handling marketing by default.

Having a wide choice of marketing tools is fine, he continued, as long as you know what you’re doing. The majority of decisions about products and services are based on word of mouth. Some marketing experts say that can be very bad or really good for a credit union, depending on whether it is indeed focused on member service and meeting a niche need such as serving the underserved. Using traditional or new media, the credit union needs to focus on what’s good for the consumer. The member may ask, ‘what’s in it for me?’

In addition, “Always focus on making sure your own house is in order,” McDonald emphasized. “What does the front line look like? Is the staff engaged? They’re not just a teller. They’re not just a loan officer. They have the power to make a difference in someone’s life. Every member has a story, and you have to take the time to listen.”

Christina Blackman, marketing manager at $180 million Yolo Federal Credit Union in Woodland, Calif., has seen the impact of tight budgets. That has meant trying to do a lot with less, being as efficient as possible, and repeatedly showing the return on marketing investments.

She has also seen credit unions using a lot less print advertising and turning more to on-line and mobile options.

“Marketing has changed,” Blackman said. “Technology has created a very different marketplace for us depending on what target segment we’re trying to reach. There’s still a place for print advertisements if you’re trying to reach an older market. We have a really good local publication in Davis that is highly read, so if we’re trying to attract a certain specific segment it will work very well.”

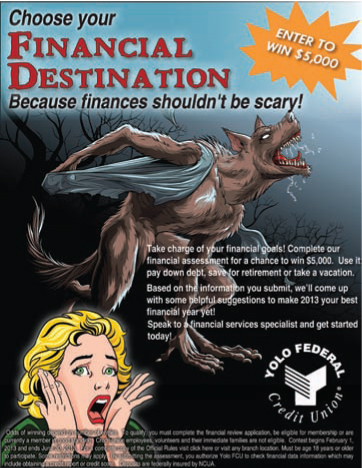

Then there’s a campaign and contest targeted to a younger audience. One execution, featuring a threatening werewolf, proclaims finances shouldn’t be scary. A member who completes a financial assessment is entered to win $5,000.

The assessments allow frontline staff to review members’ accounts and credit history and look for opportunities to help the member reach a financial goal. It builds on Yolo FCU’s new mission statement: “We help you achieve financial success and build wealth.”

The assessments allow frontline staff to review members’ accounts and credit history and look for opportunities to help the member reach a financial goal. It builds on Yolo FCU’s new mission statement: “We help you achieve financial success and build wealth.”

“We’re in a smaller market than many larger credit unions so community involvement is a big part of our public relations and advertising,” Blackman said. “People share information more readily than ever before. When we ask members how they learned about us, usually it’s from somebody they know – a family member, friend or co-worker.”

Sometimes, a marketing opportunity that can reach across new and traditional media actually walks into a credit union. Case in point – Lake Michigan Credit Union’s new campaign with HGTV host Carter Oosterhouse.

It just so happens that Oosterhouse, known for cable TV programs on home renovation and design, is from western Michigan and is a member of the credit union. He visited the LMCU mortgage office in Traverse City to arrange a home loan. Sandra Jelinski, LMCU president/CEO and an HGTV fan, heard about the transaction and suggested Oosterhouse would make a good LMCU spokesman.

Oosterhouse was very receptive, and the credit union worked with him and his agent to arrange the details. This is the first time the credit union has used a celebrity spokesperson and Don Bratt, vice president, discovered there are indeed a lot of details.

“His schedule is very busy,” Bratt noted. “It takes a lot of time and due diligence to select an individual that has the same values as the credit union and shares the same attitude toward member service. That way you’re working in tandem.”

The campaign, which broke March 1, will stretch across multiple media including television, radio, print, outdoor, point of sale, Internet, social networks and member communications. The $2.7 billion credit union, headquartered in Grand Rapids, now serves Michigan’s entire Lower Peninsula.

The launch included a $25,000 Home Marketing Giveaway which had already drawn 16,000 entries by mid-March. Entries can be made on the credit union website or at LMCU branches. Entrants can increase their odds when friends enter through a Facebook link.

“Anyone can enter, members and nonmembers alike,” Bratt explained. “The sweepstakes will run until April 30 with a single drawing May 17. The winner will get not only a $25,000 cash prize but also advice from Carter about design ideas and eco-friendly building tips.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.