The working group included Ways and Means members Adrian Smith (R-Neb.), John Larson (D-Conn.), Aaron Schock (R-Ill.), and Richard Neal (D-Mass.), and about a dozen congressional staff members. The group will forward its finding to the Joint Committee on Taxation, which will compile all comments and submit a report to the full Ways and Means Committee by May 6.

The working group included Ways and Means members Adrian Smith (R-Neb.), John Larson (D-Conn.), Aaron Schock (R-Ill.), and Richard Neal (D-Mass.), and about a dozen congressional staff members. The group will forward its finding to the Joint Committee on Taxation, which will compile all comments and submit a report to the full Ways and Means Committee by May 6. Becker said he doesn't think the credit union industry would survive if it were taxed. Credit unions would have to raise loan rates, charge higher fees and compromise service to make room on the balance sheet for taxes.

"As a result, I think they will all convert to banks," he said, "which is what the bankers essentially want."

Recommended For You

John Magill, CUNA executive vice president of governmental affairs, said the working group asked a couple of questions about the original reason behind the credit union tax exemption, and overall he felt credit unions made a strong case.

As credit unions lobby for continued tax exemption, they face conflicting reports regarding just how much revenue the federal government is forfeiting as a result.

The Congressional Joint Committee on Taxation put a 2012 estimate of lost revenue due to the exemption at $500 million. That's the figure trade associations say they're using on Capitol Hill because it came from within Congress, which will be writing tax reform bills.

However, the trades are also using the figure because it's far more flattering than other estimates. President Barack Obama's 2014 budget, released April 10, reported a hit to the Treasury that was almost three times higher, putting the value at $1.44 billion in 2012. Obama's budget also ominously describes the credit union tax exemption as an "expenditure."

Credit union income was listed first in the financial institutions and insurance section of the 2014 budget expenditures estimates, available on the White House's website. The bank Subchapter S tax exemption was not listed among the expenditures.

The list included nearly 200 items, including some politically unpopular exemptions that seemingly have no chance to be eliminated, such as the exemption on employer health care premium contributions and the mortgage interest deduction, the top two expenditures in terms of potential fiscal impact.

In the summary section, the president's budget proposes to raise "$580 billion in additional revenue relative to the end-of-year tax deal, from tax reform that closes tax loopholes and reduces tax benefits for those who need them least."

As if that wasn't bad enough, a U.S. Government Accountability Office report released April 15 supported Obama's figures and mentioned credit unions several times. The GAO reported the Treasury's estimated corporate revenue loss due to the credit union tax exemption was $1.1 billion in 2011. The Corporate Tax Expenditures report said that of the $181 billion in estimated corporate tax revenue losses, 81% was concentrated in the international affairs and housing and commerce budget functions, exceeding their federal outlays. The credit union exemption is categorized under housing and commerce but represents just 0.61% of corporate tax revenue losses, the report said.

"The 24 tax expenditures used only by corporations in 2011 provide support intended to encourage certain activities, such as energy production, or provide support for certain entity types, such as credit unions," the report said.

The GAO also included a special section, one of only four, that explained the historical basis of the credit union tax exemption. It cited the H.R. 1151, the Credit Union Membership Access Act of 1998, which said credit unions retain exemption because of their "cooperative, not-for-profit structure, which is distinct from other depository institutions, and because credit unions historically have emphasized serving people of modest means."

The value of the credit union tax exemption is hard to pin down, because it's tough to predict how credit unions would react to being taxed, said CUNA Chief Economist Bill Hampel. That uncertainty makes the assumptions used by those who estimate the tax exemption's value important, he said.

Because many credit unions have more than enough capital to meet NCUA requirements, they could reduce income to minimize their tax burden. That would minimize the income gained from eliminating the tax exemption, he said. Additionally, Hampel said credit unions may convert to mutual savings bank charters, further minimizing projected revenue.

CUNA's numbers, presented to the working group April 11, estimate credit unions produced $8 billion worth of savings, which includes both $6 billion in direct savings comparing credit union rates and fees to banks, and another $2 billion in savings thanks to the moderating influence credit union competition has on bank pricing.

As members of Congress mull tax reform, they'll get an earful from bankers visiting Washingtonthis month lobbying hard against the credit union tax exemption. The American Bankers Association brought approximately 1,000 bankers to Capitol Hill April 15–17 for its annual Government Relations Summit. Fighting the credit union tax exemption was listed among the top speaking points and was the featured topic for the group's April 16 general session, "Credit Union Taxation: Now is the Time." Adding insult to injury, an ABA video for attendees promoting the event features a photo of bankers shaking hands with a smiling Rep. Ed Royce (R-Calif.), a frequent sponsor of credit union legislation and a vocal credit union supporter.

The Independent Community Bankers of America will invadeWashingtonthis week, hiking Capitol Hill as part of their trade's annual Washington Policy Summit April 24 and 25. The ICBA summit agenda does not include a session on credit union tax exemption. However, the ICBA actively lobbies Congress against what it calls the "Credit Union Power Grab," referring to legislative attempts to increase the member business lending cap and permit credit unions to hold supplemental capital on their books.

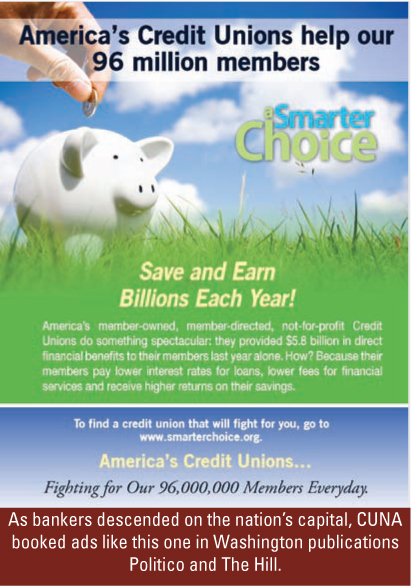

In preparation for the events, CUNA booked ads inWashingtonpublications Politico and The Hill to coincide with bankers' visits to Capitol Hill that tout credit union benefits to consumers.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.