The idea that branch banking could suffer the same fate as music stores and bookstores is typically greeted with a variety of reactions from disdain to panic to outright denial. There's a grassroots belief among many of the incumbents that branches are still at the “core” of banking, but if we can see the same trends occurring in branching as we've seen in other industries, then we must be able to draw the same conclusions about the eventual and likely impact to the industry from a distribution perspective.

The Death of the Branch

- Day One: Amazon, Apple, Kindle light the fire under e-commerce.

- Day Two: Changing consumer behavior drives down branch use, profitability.

- Day Three: The inevitable end of bricks-and-mortar branching.

So let's have a look at the data we can see that shed some light on the future.

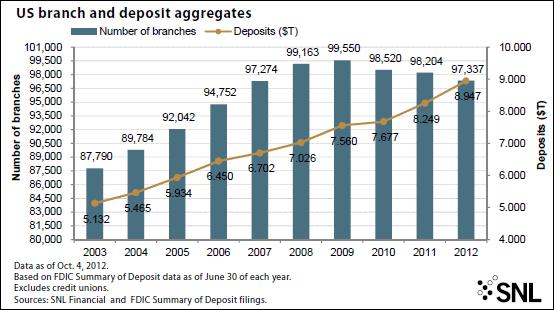

Branch Growth is Flat for the First Time in 100 Years

2008 to 2012 were all record years for branch closures in the United States with average closures exceeding 2,000 branches annually (the actual number of closures last year was 2,267). While some new branches were also opened in those years, there was a net loss of 1-2% each year, which doesn't sound like a lot, but keep in mind that since 1966 there had only ever previously been one year (1986) when we'd seen an overall decline in the total number of branches. In the past four years we've seen it every single year.

These are U.S. figures but in the U.K. this decline has been happening since 1990 and we're seeing the same trends in Australia, New Zealand, France and Germany.

By the time that FDIC figures are showing annual declines of 5% to 10% in the number of branches operating, it will already probably be too late for many branch-led businesses to respond productively, just as it was for the likes of Borders and Blockbuster. So the real issue is that can we see data that might lead to greater velocity of closures in the near term.

In-Branch Revenue is Declining

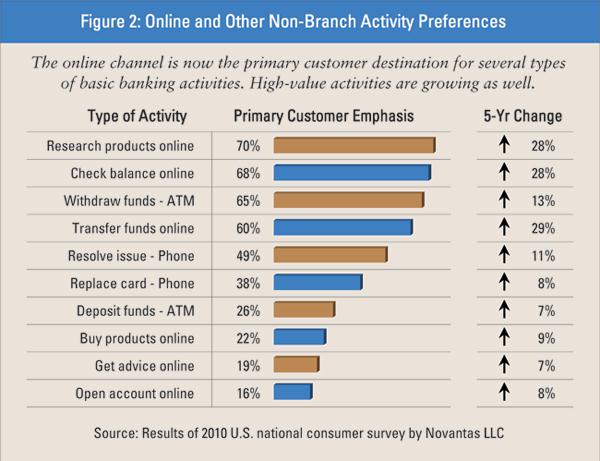

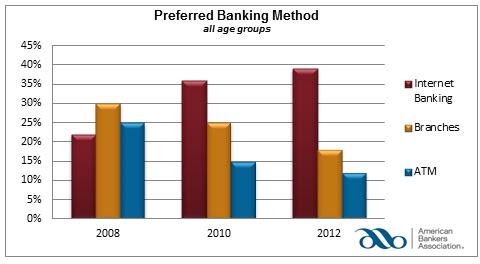

By almost every branch activity measure, preference for branch is declining in day-to-day bank interactions. While account opening is still the preference for three-fourths of new customers, that is down 11% in the past five years and the decline is speeding up due to mobile and online account opening options available to customers.

Activity has clearly shifted to non-branch channels for day-to-day banking activities as a result of convenience and ease-of-use.

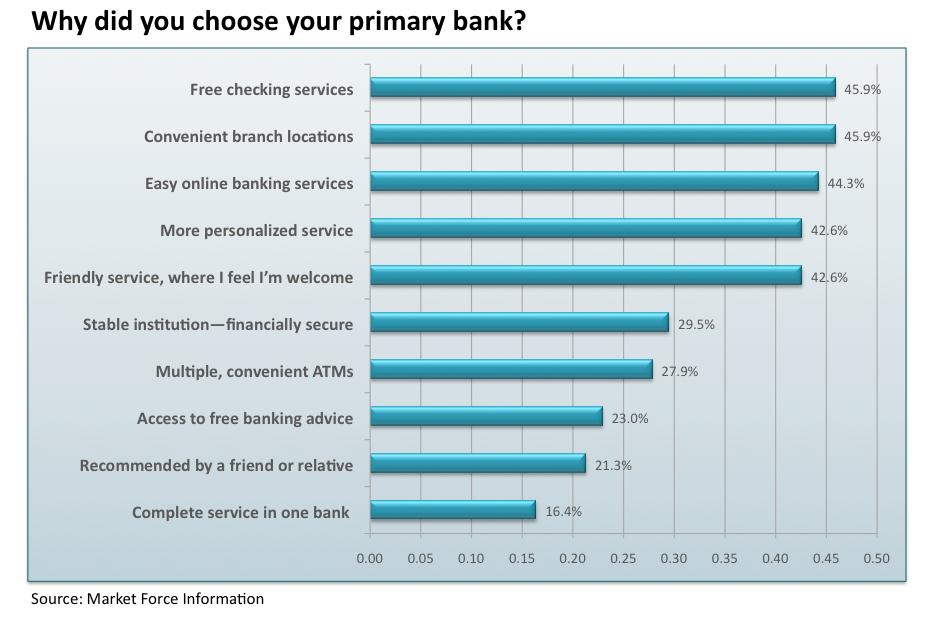

When looking at branch placement, we're always heavily focused on branch location as a driver of convenience for customers to access the real estate. The truth is today, though, that customers just find other channels far more convenient. But that doesn't always gel with survey responses when we ask customers how they choose a new bank.

The problem with surveys like this is two fold. Firstly the surveys are asking the wrong questions – where does mobile or online sit in this survey? Secondly, while psychologically a branch might still factor into a decision around the choice of a potential financial institution (when you ask in a survey) that psychology simply isn't translating into either visits for individual customers or driving new revenue in-branch.

While good branches are getting some increase in overall activity due to natural growth in the customer base, the reality is that most branch banking has been flattening out on a trending basis for close to a decade now.

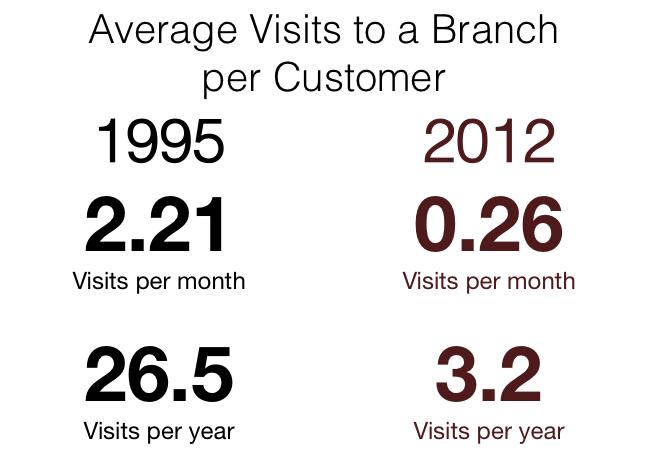

A great measure of branch activity is simply how often the average customer visits a branch every month or every year, but finding data on annual average visits per customer per branch is like finding a needle in a haystack. Primarily this is because prior to the late 90s banks never had an alternative revenue source outside of the branch. However, it can be ascertained by looking at customer transactions or inquiries and simply aggregating interactions in-branch up to a maximum of one visit per day regardless of the number of transactions/enquiries.

This then gets us the number of days a year the customer visited a bank branch as a comparative measure. That number is a great indicator of the viability of the bank branch. So after extensive research I was able to come up with a blended average for the U.S. market by talking to top 10 U.S. banks and a selection of smaller credit union and community banks at a regional and state level. The numbers are enlightening:

Changing Retail Banking Consumer Branch Visit Behavior (Source: Bank 3.0 research)

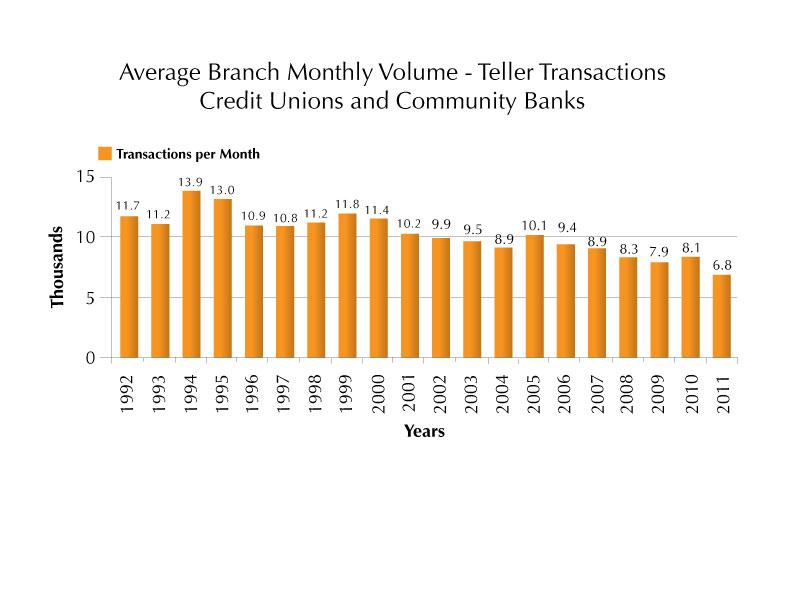

This decline in average annual visits per year can largely be explained as a function of changing behavior around transactional banking as a result of the appearance of the ATM in the late 1980s followed by Internet banking in the late 90s.

In most developed economies this meant that Internet banking surpassed branch as the primary day-to-day channel for banking somewhere around 2008-2009. Since then the requirement to go to a bank branch for day-to-day transactional activity has been declining.

The ability to research products online has also been steadily improving. So while the change in consumer behavior started with transactional activity, it has now extended to product research and advice. I just don't need to go to the branch as much as I used to, so these figures should not really surprise anyone.

Mobile use is rapidly accelerating, including mobile-only use (See NetBanker analysis from ComScore research). Already half of smartphone users in the United States are using mobile banking regularly (source: Federal Reserve Survey) – and that equates to one third of the total population. This, too, is having an impact on the need to visit a branch for basic transactional activity, further applying pressure to behavior that would support branch longevity.

Think about check deposits. With remote check deposit capture capability I don't need to go to a branch to even deposit a check anymore – further reducing my dependence on the physical space.

Decline in Average Monthly Branch Transactions (Source: FMSI)

The problem is if I am not going to a bank branch to do everyday banking, the likelihood of me engaging in a sales event or discussion is also reducing.

Next … Death of the Branch Part 3: The (Falling) Numbers Don't Lie

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.