More dealership alliances, better marketing, lower rates or a combination of all three?

These may be among the factors that have helped some of the industry's largest credit unions, notably those in the billion-dollar asset range, to become frontrunners in the auto lending sector.

The data clearly shows which cooperatives are leading the pack. According to CUNA Mutual Group's March “Credit Union Trends Report,” credit unions with assets ranging from $404 million to $52.4 billion accounted for 80% of vehicle loan growth in 2012.

Forty-nine percent of credit unions reported positive vehicle loan growth and the 510 largest credit unions by asset size accounted for 80% of 2012's gain, the report's data showed. The 197 billion-dollar credit unions also accounted for 57.9% of that growth. On the other end, a total of 145 credit unions in the 510 large credit union category group reported declines in their auto loan portfolios.

Among the factors that have led to strong auto loan activity are the robust sales of stronger, new light vehicles, less generous financing incentives from captives and lower rates at credit unions, noted the report, which tracked data through January.

“The nation's credit unions are helping consumers and members lead the recovery. Record mortgage refinances improved member household cash flow and falling vehicle loan rates helped make vehicle replacement more affordable,” said Dave Colby, CUNA Mutual chief economist.

Another sign that consumers may be more willing to shop again can be seen in new vehicle loan originations. The $6 billion gain in new vehicle loans accounted for 22% of all credit union loan growth during 2012, according to the trends report. Indeed, new vehicle loan rates were down almost 0.5% over the past year to 3.41%. The 8.9% gain in used vehicle loans is the best performance since early 2004, the report noted.

Meanwhile, there's more evidence that larger credit unions are bringing in the bulk of auto loans.

Competing with some of the nation's biggest banks, five of them recently made the list for the 25 largest auto lenders among depository institutions in the United States.

According to SNL Financial, the $15 billion Pentagon Federal Credit Union, which ranked 22nd, posted the highest quarterly growth rate in auto loans among the top 25 for the fourth quarter in 2012. The Alexandria, Va.-based cooperative grew its portfolio by 10.9% during that period by pricing its loans very competitively, the data showed.

“Not including any current rate specials, Pentagon Fed's average rate on a 60-month new car loan was 2.74% as of SNL's most recent rate collection date, significantly below the national average rate of 4.24%,” according to Charlottesville, Va.-based data and analytic firm SNL Financial.

Other credit unions that made the top 25 auto lender list were the $52 billion Navy Federal Credit Union in Vienna, Va., which ranked 14th, $6 billion Security Service Federal Credit Union in San Antonio, (No. 17), $5 billion Alaska USA Federal Credit Union in Anchorage, Alaska (No. 23) and the $5 billion America First Federal Credit Union in Riverdale, Utah (No. 25).

Auto loans amassed during the fourth quarter were $691 million at Navy Federal, $520 million at Security Service FCU, $271 million at Pentagon FCU, $224 million at Alaska USA FCU and $170 million at America First FCU.

According to SNL Financial, Ally Financial Inc. in Detroit ranked first in its top 25 list of the top auto lenders followed by Wells Fargo & Co. in San Francisco, JPMorgan Chase & Co. in New York, Capital One Financial Corp. in McClean, Va., and Bank of America Corp. in Charlotte, N.C.

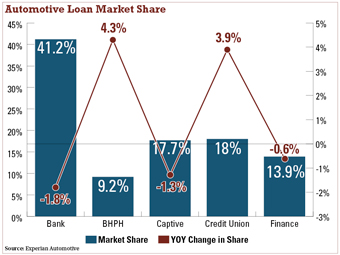

Regardless of the asset size or whether the financial institution was a credit union, bank or other lender, lower interest rates and longer loan terms made it easier for consumers to finance a vehicle in fourth-quarter 2012, according to Experian Automotive. Average loan terms for a new vehicle during those three months jumped to an all-time high of 65 months, up from 63 months in fourth-quarter 2011.

Experian's fourth-quarter state of the automotive finance market report also showed that the average loan amount for a new vehicle was $26,691 in fourth-quarter 2012, up $272 from the same quarter in 2011, while the average used vehicle loan was $17,629 in 2012, up $239 from 2011, both in the fourth quarter of those years.

While consumers are taking out larger loans, lower interest rates and longer loan terms for new vehicles helped bring down the average monthly payments. Experian said the average monthly payment for a new vehicle dropped in the fourth-quarters, from $468 in 2011 to $460 in 2012.

The average interest rate for a new vehicle loan in 2012 dropped to 4.36%, from 4.52% in 2011. The average interest rate for a used vehicle loan dropped to 8.48%, from 8.67% during the same period.

“Lower interest rates and longer loan terms made it easier for consumers to finance a vehicle while keeping their payments affordable,” said Melinda Zabritski, director of automotive credit for Experian Automotive. “This, combined with the fact that more vehicle loans went to consumers with credit outside of prime, portends a vital and healthy automotive market.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.