Jabs over regulatory reform, budget cuts and shout outs were all part of the first day of NAFCU's Congressional Caucus in the Renaissance Mayflower Hotel in Washington.

- MORE Caucus coverage: California Clash Over Cash

- MORE Caucus coverage: Sen. Sanders Reaps Boos in Ryan Attack

- MORE Caucus coverage: MBL Vote Seen Unlikely This Year

- MORE Caucus coverage: NAFCU Study Defends Tax Exemption

- MORE Caucus coverage: CFPB Hit, Hugged at Podium

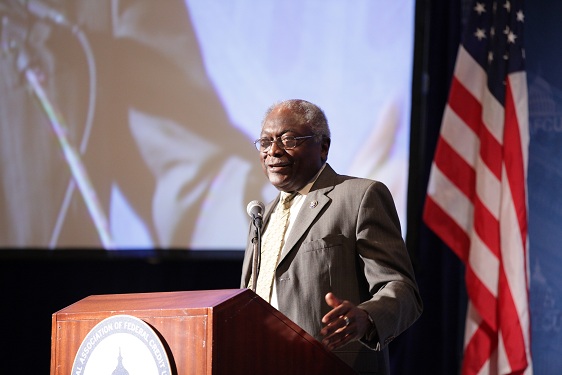

- MORE Caucus coverage: Rep. Clyburn Reassures on 'Fiscal Cliff'

- MORE Caucus coverage: Tower FCU Marketer Wins Paul Revere Award

- MORE Caucus coverage: Day 1 in Pictures

- MORE Caucus coverage: Day 2 in Pictures

- MORE Caucus coverage: Day 3 in Pictures

Rep. Jim Clyburn (D-S.C.) tells Caucus attendees that he would bet Congress will step back from the "fiscal cliff," after the November elections, but also said he has been known to lose a bet.

NCUA Board Member Michael Fryzel took attendees on a tour through early U.S. history with a focus on the qualities of leadership held by the country's founders. He urged NAFCU to seek out some of the same qualities in the candidates and legislators it chooses to back now.

Recommended For You

Dan Berger, executive vice president of government affairs for NAFCU, reminded attendees that, as constituents, they have more power with their legislators than NAFCU executives and lobbyists will ever have.

Donald Layton, CEO of Freddie Mac, gave his first public speech as CEO to NAFCU. He used part of it to apologize for not being able to say more about reforms at Fannie Mae or Freddie Mac. As a condition of their government takeover, the two organizations are strictly enjoined from lobbying or participating in public debate about their future.

Rep. William Clay (D-Mo.) spoke vigorously in defense of the Consumer Financial Protection Bureau and the Dodd-Frank Act and thanked NAFCU several times for supporting him during a tight primary race.

Rep. Jeb Hensarling (R-Texas) assailed the Consumer Financial Protection Bureau and the Dodd-Frank Act, drawing approving applause several times.

Rep. Michael Grimm (R-N.Y.) told attendees that he feared the Consumer Financial Protection Bureau's impact on local businesses and questioned why the agency is directed by one person instead of a board.

Economist Robert Feinberg of American University shared some findings from his study about the impact of credit unions losing a federal tax exemption.

Douglas Meade of the Interindustry Economic Research Fund discussed the paradox under which the federal government would actually lose tax revenue if it removed credit unions' tax exemption.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.