Money from the U.S. Treasury Department's Community Development Financial Institutions Fund's latest round of funding will help credit unions offer members alternatives to high cost payday and auto loans, improved savings options, financial education and loans to bring fresh food into neighborhoods that currently do not have any, according to the CDFI fund and credit union executives.

The CDFI fund has announced almost $20 million in grants to community development credit unions and credit union organizations, according to the National Federation of Community Development Credit Unions that tracks the grants.

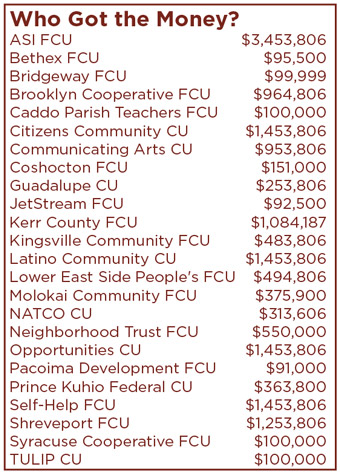

The federation reported that credit unions received 12% of the CDFI's overall grants during the latest round and that 83% of the CDCUs that received money were National Federation Members (see sidebar).

The National Federation received a grant of $1.4 million that it will use to support programs with its member credit unions, while the Support Center, an organization that works with CDCUs in North Carolina, received $953,000 and two organizations that work with Native American CDCUs, the Bois ForteBand of Minnesota Chippewa, and the Lakota FCU steering committee received $74,000 and $147,000, respectively.

Pamela Owens, interim CEO at the National Federation, celebrated the grants and pointed out that they are part of an ongoing tradition of CDCUs making the most out of their CDFI grant money.

“A recent study released by the CDFI fund shows that CDCUs mobilize $10 in community assets for every dollar of capital, which is more than any other type of CDFI,” Owens said. “We've known this for a long time, but were pleased to see the power of cooperative finance recognized by the CDFI study.”

Many of the recipients had received CDFI grants before.

Communicating Arts Credit Union in Detroit, Mich., was given a grant of $953,806 this year, and CEO Hank Hubbard noted through the National Federation that the Detroit community has benefited greatly from the CDFI fund in the past.

“These grants allow us to reach out further into the impoverished areas of Detroit that other legitimate lenders cannot or will not go,” Hubbard told the National Federation. Communicating Arts also received a CDFI grant in 2011. “The 2011 funds allowed us to refinance predatory car loans for approximately 100 people, saving them an average of $80 per month,” Hubbard said. “That's a total savings for the group of over $400,000 through the life of the loans.” And the benefits continue to grow. “As the members pay the loans back–we can lend it out again,” he added.

Another recipient, ASI Federal Credit Union, headquartered a New Orleans suburb, received money under the CDFI program as well as money under the Healthy Food Financing Initiative, which the CDFI fund administers.

ASI received just over $1.45 million from the CDFI fund and $2 million in HFFI funds. ASI CEO Mignhon Tourne reported that the CDFI money will continue to support the credit union's small business loan programs and that the HFFI money would do something similar but in the food field.

Tourne explained the credit union was using money from the HFFI initiative and from a similar program from the state to support a food cooperative in the Upper Ninth Ward, an area of New Orleans still struggling after Hurricane Katrina.

ASI is one of only 12 financial institutions and other organizations in the country eligible for the funding under HFFI.

She also reported that ASI is approaching the end of its first year as lending partner for Kiva.org, the organization that allows individual donors to fund individual small business loans around the world.

Tourne reported that the credit union has underwritten and financed roughly 39 of the small business loans so far for Kiva for about $345,000. The credit union initially underwrites, funds and services the Kiva loans that the organization's donors then back fill.

Tourne reported the loans have created 35 jobs and preserved more and that 66% of them went to women-owned businesses and 89% to minority-owned businesses. Ninety-two percent of them went to lower income members.

The loans have 10% delinquency rate but only a 2% default rate, Tourne said, adding that the credit union didn't consider even that 2% lost. “We have a very talented and creative collection team at ASI, which is always reaching to those members to help them find a way to bring their loans current,” she said. “We don't count them out.”

But not all credit union CDFI recipients were old hands on the process. Sandra Lumbley, CEO of the Kerr County Federal Credit Union in Kerrville, Texas, told the National Federation that the CDFI money would go to help her credit union members escape the trap of high-cost payday loans.

“Our credit union is dedicated to serving the underserved,” Lumbley said, “and this grant will be put to great use in our community.” The grant will be used to increase specialized lending that helps low-income borrowers to break free from predatory lenders. “We serve many members that traditional financial institutions can't or won't,” she added. “Our loans help people who believe that high interest payday and title loans are their only option.”

Some of the CDFI money went to help credit unions become certified as CDFI's. Jeanne Kucey, CEO at the 16,000-member JetStream Federal Credit Union of Miami Lakes, Fla., said the bulk of the $93,000 her credit union received will go to help it become recognized as a CDFI.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.