Some are calling it the strongest comeback to emerge from the dregs of the Great Recession.

From the last year's drop in gasoline prices to a bevy of lures rolled out by manufacturers to woo shoppers, the auto industry is on track to post its highest volume since the year before the economy took a turn for the worse in 2008.

Sales growth are in the double digits, with domestic car and truck sales increasing 25% since 2011, according to Auto Nation Inc., which tracked activity through June 2012. The sale of imports skyrocketed 56%, with more than 11,500 cars and trucks sold in June alone.

Indeed, major automakers are basking in the surge. Toyota Motor Corp. recently reported a 60% increase in sales in the United States between June 2011 and June 2012. Good news for the third largest automaker, which had to halt or significantly delay production last year following a destructive earthquake and tsunami in Japan in March 2011.

Automakers based in the U.S. are also on a sales high. In June, Chrysler was among the leaders with a 20% increase in sales followed by General Motors at 16% and Ford up 7%.

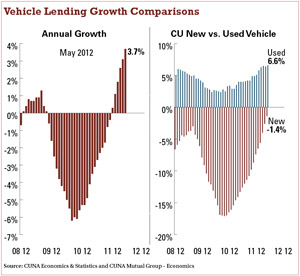

For credit unions, the resurgence has helped to grow auto loan portfolios, particularly on the used vehicle side. Many have said they are in a more competitive position as credit union loan rates continue to fall, according to CUNA Mutual Group's latest “Credit Union Trends Report.” As of April, the industry experienced a 2.3% gain in auto loans, the best posting since 2009 with $1.1 billion of the $3.9 billion annual gain directly tied to growth occurring this year.

“What's behind all of this is more people are buying and cars are cheaper to buy now,” said Robert O'Hara, president of cuautocoupon Inc., a Hauppauge, N.Y.-based provider of discounts and refinancing incentives to members at more than 20 credit unions.

“The rebound seems to always be there for autos when the economy goes in the tank, for lack of a better phrase,” O'Hara said. “It's usually the first to go out and the first to come back.”

That revival has also brought out more aggressive competition with dealers touting 0% financing on new cars in a race to latch on to eager shoppers.

“We've had to adjust our strategy a bit. We're seeing the greatest interest on used autos,” said Teri Rapp, chief credit officer at the $1.2 billion NuVision Credit Union in Huntington Beach, Calif. “We're offering the same pricing on new and used for our members.”

The 0% financing has certainly changed the way NuVision is courting potential buyers from continuing to adjust rates to car sale partnership promotions, which have proven to be successful. A goal of $1.2 million was set for a May used car sale on the credit union's property. NuVision surpassed that bringing in $1.7 million and several new member relationships, Rapp said.

In addition to partnering with Autoland Inc., a vehicle buying CUSO in Chatsworth, Calif., and using traditional advertising, which has yielded many pre-approvals, NuVision has installed loan kiosks in its branches so that members can apply online, connect with a representative and get approved in one swoop.

“We want to capture them before they go shopping,” Rapp said.

Another edge is taking the time to educate members on what's really behind that so-called tantalizing 0% deal.

“When you start to educate them on what they're getting for the pricing adjustment and the adders, they can see the actual loan balance,” Rapp said. “If you do a side by side comparison, we have rates as low as 1.99%.”

Overall, NuVision's auto loan business is up 11% for new and used–a strong showing for the credit union, Rapp said. Direct loans accounted for $87.2 million while indirect loans were at $48 million as of July, she added.

After pulling out a few years ago, NuVision revived its indirect lending activity in 2011. This time around, the credit union is taking it slow, monitoring it carefully, limiting the number of dealers it works with and has established stricter criteria for indirect lenders. Rapp said the lowest FICO band score is around 635, but NuVision is starting to evaluate if that's sturdy enough to protect it from risk.

As the auto market reshapes, members with higher credit scores will once again have the largest number of suitors. Unfortunately, the reality for some credit unions is they just won't be able to compete with dealer financing when it comes to individuals with 700-plus FICOs, said Eddie Nevarez, vice president of business development at the National Auto Loan Network in Newport Beach, Calif., which counts more than a dozen credit unions among its clients.

“As of late, the trend that we see in the new car market is very fierce competition in financing. We are hearing from our credit union partners that they cannot compete with 0% to 1.9% financing,” Nevarez said.

Still, credit unions can take advantage of recapturing those loans financed with the dealer in the 650 to 699 range and many others who may have been misplaced in a loan from the dealership for various reasons such as being a first-time buyer of having moderate credit, he offered.

Nevarez said while there may be a slight rebound in the auto market, a true rally will depend on the housing market. In the four states hardest hit–Arizona, California, Nevada, and Florida–new auto registration is still on the decline,

“But the silver lining is in the auto refinance market in these states. We are seeing members with moderate to prime credit taking advantage of low auto rates offered by credit unions,” Nevarez said.

For some, the verdict on refinancing opportunities is mixed. O'Hara at cuautocoupon said many members don't know they can refinance their auto loan, which potentially creates an opening for credit unions to educate them. Rapp at NuVision said refinancing activity has been slow at NuVision.

The $1.8 billion Grow Financial Federal Credit Union in Tampa, Fla., recently launched a promotion that pays members $300 at closing for refinancing their auto loan with the financial institution.

“In the past, refinancing has brought in strong numbers and our turnaround on refinancing on new cars is good too,” said Jason Moss, senior vice president of delivery channels at Grow Financial. “We've received a lot of good feedback and we're really expecting a lot of loans.”

In June, the credit union brought in $20 million in new growth loans including auto loans, which added to Grow Financial's $524 million consumer loan portfolio, Moss said. Despite the increased competition and lower rates brought on by the auto market's U-turn, there is more room to grow.

“We go back to competing on service,” Moss said. “We primarily see most of our activity on used. I would say new is starting to pick up as the economy turns around. Indirect has been very well–we had record growth in the last two months.”

The scenario was quite different in 2008 and 2009, the years commonly referred to as the Great Recession. Moss said Grow Financial maintained a very conservative eye on auto loans as people stopped buying cars and lenders scaled back significantly.

“What we're seeing now is the market is coming back,” Moss said. “More people are interested in the auto loans were offering and in general, overall lending.”

While credit unions may not be offering the lowest rates to hitch on to the momentum, the industry continues to see a drop. The estimated national average credit union new vehicle loan rate of 3.77% was down 78 basis points since April 2011 and the used vehicle loan rate was down 72 basis points to 4.35%, according to CUNA Mutual's Trends Report. Those rates are far away from the average rate of 7% in 2010, O'Hara said.

As of April, the new vehicle loan portfolio was down 3.5% year-over-year but still grew that month and in March. Used vehicles continued to been a significant source of total credit union loan growth with a 5.8% or $6 billion jump in April.

The most surprising discovery may be with indirect loans. More than 100% of the first-quarter gain in total vehicle loans was attributable to increases in the indirect portfolio, the data showed. Point-of-purchase financing is also poised to a key ingredient for growth.

O'Hara said there may be other areas of opportunities for credit unions to take advantage of the auto market's resurgence. For one, the average car is now about 11 years old, so people will be looking to replace their vehicles. Others might want to downsize from larger models such as SUVs to hybrids to take advantage of mileage savings. He's noticed an increase in Fiat sales over the last few months, for instance.

The one constant within the credit union industry is the struggle to capture auto loans without offering the best rates, O'Hara said. Most financial institutions are sticking with A paper, are skittish about B and C paper and are completely avoiding subprime.

“There's a market for many credit unions to go into B paper. That's good risk,” O'Hara offered. “These are good members. You've had a history with them and they're stable. Some credit unions don't know they are in the market to buy.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.