Get the headline news: mobile banking is not simply a new channel, it is a game changer – and without it, many institutions can expect to perish.

“Mobile puts the bank terminal with the user. We have never before had that kind of computing power,” said Wade Arnold, CEO of Banno (formerly T8 Webware).

David Albertazzi, an analyst with the Aite Group, pointedly added: ”Mobile banking is not online banking lite. It is a unique channel with its own features. That is prompting some financial institutions to go beyond first generation mobile banking into the next wave of features.”

Understand that: members want more from mobile banking and they want it now.

“Banking customers are focused on instant information,” said Kevin Reilly, an executive with telecommunications company Avaya which recently completed an in-depth survey of consumers and what they now want from their financial institutions.

Ina C. Fitch, CEO of Academic FCU, a $48 million institution in Briarcliff, NY, said she got that message, loud and clear, as she  watched her 20 year-old son as he stood at a store's checkout, twiddling his mobile phone, shifting money at the last second from savings to checking. “That generation has a different money mind set.

watched her 20 year-old son as he stood at a store's checkout, twiddling his mobile phone, shifting money at the last second from savings to checking. “That generation has a different money mind set.  Mobile lets us address it,” she said.

Mobile lets us address it,” she said.

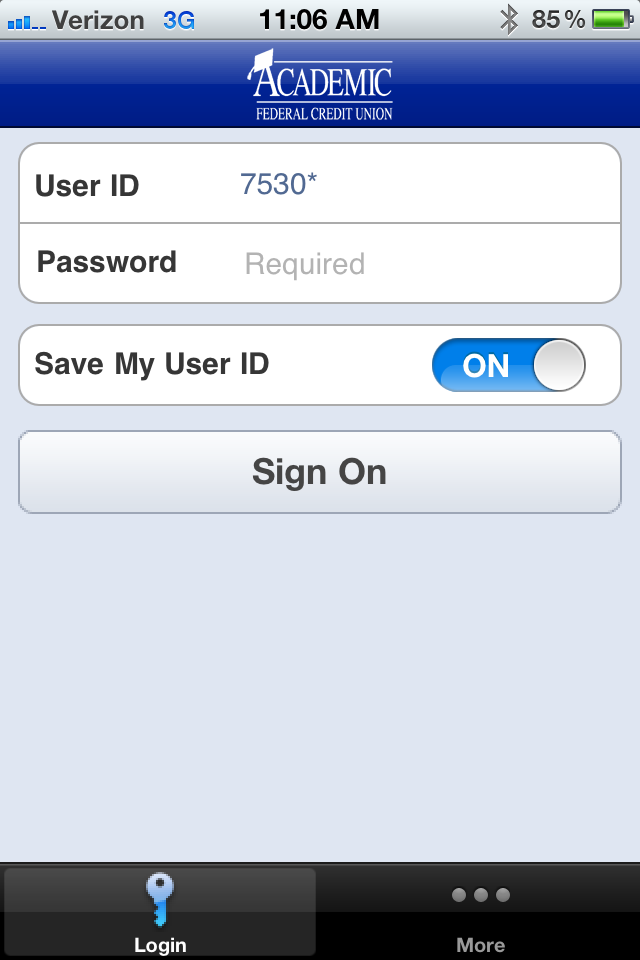

Fitch is also adamant that, while her small institution may seem disadvantaged by its size, mobile banking – which Academic rolled out a month ago – may let it compete. “We have 18 schools in our field of membership” – among the better known are Fordham and the New School – “but we only have one location. Mobile lets us be where our members are.”

A curious – but compelling – factoid noted by Fitch in the first weeks of Academic's mobile banking deployment: “We are seeing so much use between 9 p.m. and 2 a.m. Even if we had more branches, they would be closed. Mobile lets members bank when they want to, wherever they are.”

Exactly that is the game-changing essence of mobile banking. Online banking – which rolled out in 1994 and had become mainstream by 2000 – put a bank on every desk, in offices, home dens, wherever. Mobile ups that ante, dramatically, by putting banking on a device that we are so attached to that we'd rather lose a wedding ring than a cellphone, according to a new Intel survey.

Yet so much more remains to be done. Drew Sievers, CEO of mobile banking apps developer mFoundry, in an email estimated that around 1,000 credit unions presently offer mobile banking to members – making the count roughly one in seven credit unions – and of that number, guessed Sievers, maybe half offer mobile bill pay. And mobile banking without bill pay is not much to talk about,

That would put the proportion of credit unions with genuine mobile banking at well under 10%.

How long before the rest join the party? “Three to five years,” said Sievers – though a question has to be, will that much time be available?

At Island Federal Credit Union, an $817 million institution in Hauppauge, N.Y., chief operating officer Paul Young said that the  credit union had growing awareness that it needed mobile banking “because our members have been asking for it.”

credit union had growing awareness that it needed mobile banking “because our members have been asking for it.”

They will get it, too – “before year `end,” said Young, who added that Island has been painstaking in its testing (“I always worry about security”). Noted Young: “We believe mobile is essential in attracting and keeping a younger generation of members.”

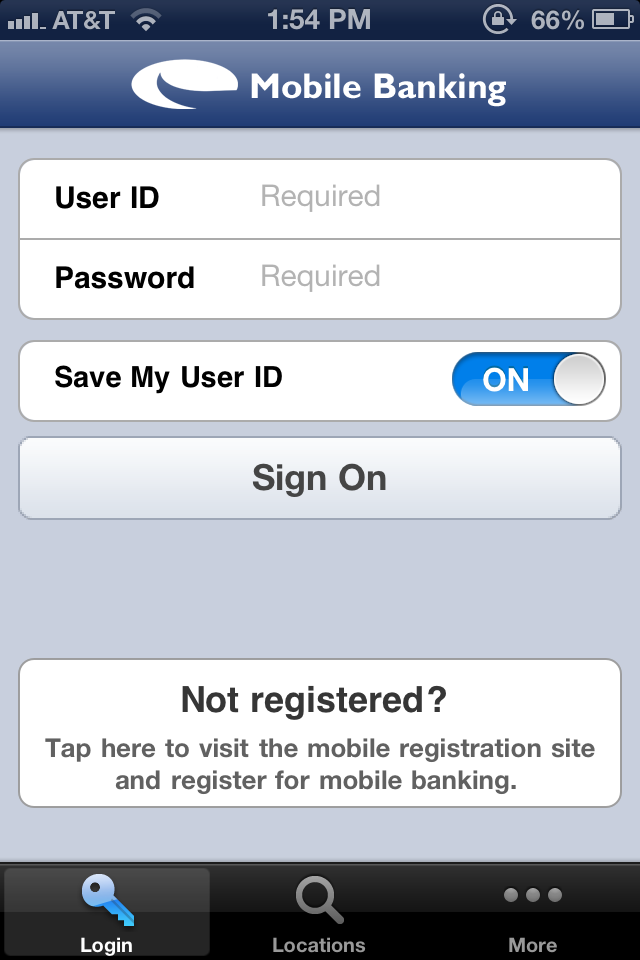

UFCU Crows About Mobile Success. Nine months into the rollout of mobile banking, Austin, Texas based University Federal Credit Union – a $1.45 billion institution with some 146,000 members – has announced it now has 20,000 mobile banking users.

An irony is that this is the institution's second go-round with mobile. In 2010 it introduced an earlier version but that provider  pulled the plug on it a month after UCFUdeployment – highlighting the importance of picking the right vendor (this time, UCFU went with mFoundry). But the other takeaway, said UFCU eservices senior

pulled the plug on it a month after UCFUdeployment – highlighting the importance of picking the right vendor (this time, UCFU went with mFoundry). But the other takeaway, said UFCU eservices senior  manager Bryan Mishkin, is that UFCU learned a lot about what it and its members don't want and do want from mobile banking in that first go-round.

manager Bryan Mishkin, is that UFCU learned a lot about what it and its members don't want and do want from mobile banking in that first go-round.

The key to UFCU's second take on mobile: it is stand alone. It does not require an online banking account to activate and activation can be done right from within the app (UFCU's apps are available for iPhone and Android, with an iPad app on the way). “I don't believe mobile should be chained to online banking,” said Mishkin. “A subset of users plainly wants a mobile first approach.”

Mishkin added: “We are only scratching the surface of what mobile can do. The real value add will be the innovations. Giving members more control over their money.” He pointed with considerable satisfaction to UCFU's mobile remote deposit capture function but then asked, “What are the other things you can do with the camera? That opens a lot of possibilities.”

As the Apple Turns. Ever cryptic – that has long been Apple on mobile payments and this has led some pundits to positthat NFC (Near Field Communications) is going nowhere until Apple embraces it. Now reporter Jessica Vascellero, writingin the Wall Street Journal, has documented what Apple is doing: “Holding back in mobile payments was a deliberate strategy, the result of deep discussion last year. Some Apple engineers argued for a more aggressive approach that would integrate payments more directly. But Apple executives chose the go-slow approach for now.”

Nor is there any indication that Apple will embrace NFCin the next edition of the iPhone, due out later this year.

Bottom line: Apple likely will not ride in on the proverbial white horse to pluck NFC from the indifference and lack of use that now plague it. Where Apple excels is in taken proven platforms – such as MP3 music or cellphones – tweaking a product, packaging it very creatively, and then going to market with a snazzy version of an established product category. And that is not NFC, which will need to be propelled into many more hands by other saviors, still unidentified.

That is no death knell for mobile payments – which from PayPalto Fiservremains a key focus. It's just that NFC may not be the glue.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.