The NCUA Tuesday released its first NCUA Quarterly U.S. Map Review featuring analysis of key financial indicators on a state-by-state basis for federally insured credit unions on the regulator's website.

"The NCUA Quarterly U.S. Map Review highlights the diversity of credit union performance across the nation, reflecting local economic conditions, specific state strengths, and current challenges," said NCUA Board Chairman Debbie Matz. "This new product from the Office of the Chief Economist is part of an ongoing effort by NCUA to provide timely, easy-to-use analysis of credit union data to the public. With this information, credit unions can make better decisions and the public can gain a greater understanding of how credit unions are performing."

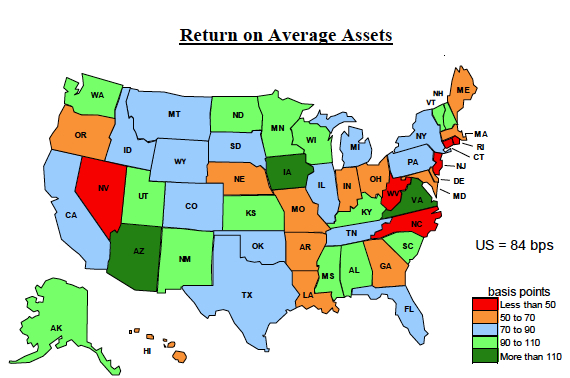

Credit unions' national return on average assets stood at 84 basis points in the first quarter of 2012, up 17 basis points from the year-end 2011. During the first quarter of 2012, 40 states and territories had increases in ROA compared to the first quarter of 2011. Eleven states and territories had ROA of 100 basis points or higher, while only six states had ROAs of less than 50 basis points.

Recommended For You

Nationally, 74% of credit unions had positive ROA in the first quarter of 2012, compared with 71% in the first quarter of 2011 and 68% in the fourth quarter of 2011. Fifteen states and territories had more than 80% of credit unions report positive ROA for the first quarter of 2012. Only New Jersey reported less than 60% of credit unions with positive ROA.

In the first quarter of 2012, the national delinquency rate fell to 1.44% from 1.63% in first quarter of 2011 and 1.60% in the fourth quarter of 2011. From the first quarter of 2011, 41 states and territories had declines in delinquency through the first quarter of 2012. New Hampshire had the lowest delinquency rate at 0.49%, while Montana had the highest delinquency of any state at 3.23% for the first quarter of 2012.

For the twelve months ending March 31, 2012, loans outstanding at federally insured credit unions grew by 2.17%. Fourteen states and territories experienced negative loan growth during the last twelve months. Forty-two states and territories increased loan growth rates relative to the twelve months ended in the first quarter of 2011. Overall, for the first quarter of 2012, total loans by federally insured credit unions grew by 0.09% for a 0.37% annualized rate.

The NCUA said the Office of the Chief Economist will prepare the NCUA Quarterly U.S. Map Review in close conjunction with the release of the quarterly industry performance statistics.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.