Since at least 2010, Telesis Community Credit Union's member business loan program has been in a downward spiral.

News Update:

April 2, 2012, Telesis Management Taken Over By Premier America

May 7, 2012, May 7, 2012, Telesis Reports $13.8 Million First Quarter Loss

On March 23, the NCUA was appointed the conservator of the $318 million credit union after the California Department of Financial Institutions placed the Chatsworth, Calif.-based cooperative in conservatorship due to declining financial conditions.

Recommended For You

A scan through Telesis' December 2011 financial performance report, revealed the story of the decline.

From December 2010 to December 2011, Telesis went from nearly $202 million in member business loans to $152.6 million at the end of last year. Total business loans dropped from $230 million to $176 million. Total loans at Telesis equaled $243 million at yearend 2011. At the same time, unfunded commitments plummeted from $1.1 million as of December 2010 to $314,000 as of December 2011.

In the non-real estate secured loans to members and nonmembers, Telesis experienced several hits to its portfolio over a nine-month period. The credit union had $5.6 million in commercial and industrial loans in March 2011 and $4.1 million in December 2011. Unsecured business loans plummeted to $966,505 at the end of last year from nearly $1.6 million in March 2011.

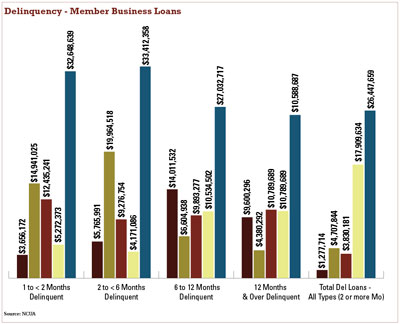

Member business loans delinquent for one year or more continued to increase from December 2010 to December 2011. Jumping from $5.2 million to nearly $18 million. For the same period, total loan delinquencies fell from $33 million to $26 million.

At the end of last year, Telesis had $144 million in participation loans outstanding, down from $176 million in December 2010 and totaling 59% of all loans outstanding at the credit union. The credit union sold $29 million in participation loans at the end of last year.

Over the past few years, Telesis made loan workout attempts to avoid placing properties in foreclosures and sued others that had defaulted.

Telesis made its entry into business lending as Telesis Partnerships LLC. In 1995, it became Business Partners LLC, a CUSO that was originally owned by more than a dozen credit unions nationwide.

While the credit union forged ahead on building its business lending program, its participation loan network continued to grow. As recently as January 2011, Business Partners had formed BP Connect, a loan participation network to connect buyers and sellers.

As of December 2011, the total balance of participation loans sold or serviced by Telesis neared the $427 million mark. Telesis retained $120.5 million in participation loans at the end of the year, down from $147.4 million in December 2010, according to Telesis' December 2011 NCUA Call Report.

Some have speculated that the $318 million Telesis overextended its business lending efforts and that reach, which included out-of-state deals, led to the credit union being placed into conservatorship.

At yearend 2010, the credit union had sold $26 million in participation loans, compared to $29 million as of December 2011. Telesis, however, had not sold or purchased any loans in full from financial institutions or other sources since at least December 2010, according to the NCUA data.

In early fall 2011, Telesis addressed reports about its safety and soundness particularly after Bauer Financial, a financial institution ratings and research firm, gave the credit union zero out of five stars based on its status as of June 2011.

Without naming Bauer or any other ratings firm, Telesis addressed the concern on its website.

"While there are a few websites that assign ratings to banks and credit unions, it's important to keep in mind that these websites often only look at a narrow range of numbers that may not accurately reflect the overall situation at Telesis or our performance in relation to other credit unions of our size and region," Telesis wrote at the time. "As one site itself states, it uses 'conservative measures when assigning these ratings and consequently the ratios will often be lower than those supplied by other analysts or the institutions themselves."

Grace Mayo, president/CEO of Telesis at the time of the credit union's conservatorship, did not return phone calls from Credit Union Times.

The NCUA said Business Partners will continue originating and servicing loans. According to Telesis' most recent NCUA Call Report, the CUSO is not wholly owned by the $318 million credit union. As of December 2011, Telesis had an investment of $4.8 million and a $10,000 aggregate cash outlay in Business Partners.

"Business Partners will continue to service the loans, business as usual," said NCUA Public Affairs Specialist John Zimmerman told Credit Union Times. "BP is a separate entity and will continue to provide loan servicing and origination."

Zimmerman said Business Partners is servicing participation interests for approximately 180 primarily credit unions, 32 of which are lead lenders.

Jean Faenza, CEO of Business Partners, did not return phone calls.

The NCUA said Autoland will continue to operate.

"There is no change or consideration of a change in Autoland's position or status with the credit union with NCUA as the conservator," Zimmerman said.

Formed in 1971, Autoland became a credit union-owned entity in 2007 through Telesis, and two other California cooperatives, Kinecta FCU, which has experienced net worth challenges, and California Agribusiness CU, whose CEO was abruptly replaced a couple of years ago, through CU Vehicles LLC, a holding company owned by the credit unions.

As of December 2011, Telesis had $3.8 million invested in CU Vehicles and an aggregate cash outlay of $12.5 million in the CUSO. The credit union loaned nearly $2.3 million to the CUSO.

Autoland referred all questions to Zimmerman.

"CUSOs are an asset of the credit union, just like facilities or loans," Zimmerman said. "The conservator will continue to represent the interests of Telesis with the CUSOs in which it has invested."

At a time when credit unions were treading lightly, Telesis was considered by some to be early leaders in the commercial lending space.

Bill Beardsley, president of the Michigan Business Connection LC, a business lending CUSO, is among those in the industry who admired Mayo's vision.

"I've always had great respect for Grace and her team and for growing Business Partners," Beardsley said of the business lending CUSO founded by Telesis.

Referring to Mayo and Faenza, Beardsley said they were innovators and leaders.

Some said much of Telesis' financial troubles may be attributed in large part to the credit union's overextended business lending program, which included out-of-state transactions.

Beardsley said securing deals outside of California may have been a challenge during the recent recession. "I have to believe their problems were compounded by their national origination model," he offered. "It's so hard to manage loans when you're so far away from home."

Beardsley was among the 15 business lending CUSO leaders that formed the Regional CUSO Alliance in 2009. The coalition's main goal is to promote sound business practices particularly with loan participation activity in their respective local markets.

"The Regional Alliance is all about lending in markets you know," Beardsley said. "That's not to say national origination models are doomed to fail, but it's so hard to manage when you can't get in your car and drive to where they are, especially in bad times."

With a heavy concentration in member business loans, Telesis may not have been prepared for fluctuations in that market. That's part of the analysis from Glatt Consulting LLC, a credit union consulting firm in Wilmington, N.C.

Looking at Telesis' HealthScore calculation, which is a composite financial performance score reflecting the overall financial health of a credit union, Telesis took a substantial hit in 2007 to its operations and failed to recover.

"When you serve a niche market, as did Telesis with its concentration on member business lending, you must be prepared for fluctuations in that market," wrote Tom Glatt, Jr., in his analysis. "Much as I hate to agree with the NCUA, understanding concentration risks, and mitigating those risks, is an important responsibility for both boards and management teams."

The firm said its HealthScore is not a predictor of future performance and while it typically does not release score data on individual credit unions, it will make public scores of those under conservatorship.

In Telesis' case, Glatt Consulting said the credit union's performance data showed the value of contingency planning for credit unions—especially those with sustained, above-average performance due in large part to a niche market focus.

"They had some early warning signs, but the deteriorating economy seems not to have given them enough time to offset the escalating problems in their MBL portfolio," Glatt told Credit Union Times.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.