//

Recommended For You

//

//

//

If David Tuyo, interim president/CEO at Pen Air Federal Credit Union, has his way, get ready for the $1.1 billion credit union to change the world.

“I'm looking forward to beating Bank of America, but we're pacing ourselves,” Tuyo said half jokingly of his Pensacola, Fla.-based credit union. “I am extremely hyper competitive, so I want us to be No. 1 at everything. For me, that energy and competitiveness really drives back down to a desire to find out what's my real potential, our team's potential and how to get to that destination.”

Involved with credit unions for 10 years, Tuyo has worked for both corporate and natural person credit unions. At each job, he has been a leader in innovation, implementing change, staff development, member development and overall increasing the value for the member and employees. While he asks a lot of his staff, it's no less than his expectations for himself. For Tuyo, who has wanted to be a champion in the financial services industry since the 8th grade, his career path and life could serve as a case study of how perseverance, determination and the power of positive thinking delivers results.

“I believe we can all live a life dedicated to becoming the student of our profession,” said Tuyo. “I was at a sales conference in 2001 speaking with Lou Holtz, who stated 'leadership comes from below and the title comes from above.' His message was don't waste time on attaining a title, be a leader now and focus on what is important to leaders–people. Success is only a measure of what you did yesterday. What I'm most proud of is what we've been working on as far as leadership development and strengthening the team and how to help everyone improve themselves.”

He added that the huge push for leadership development from skills assessment and strategic alignment in the organization has been an eye-opening experience.

“We're focused on helping people get from good to great and great to extraordinary by investing in them,” said Tuyo. “It is not just fluff talk, there is research and real results that support it. I really think if all your focus is on people and you invest in their training, well being and leadership ability, no one out there can beat you. Let's face it, if you take the people out of the equation, all that is left is just brick and mortar. Banks don't have the time to do it because they are so profit driven and focused on products and stuff, credit unions can take it to them especially now as consumers are pulling back and questioning.”

A believer in assuming positive intent and the art of possibilities, Tuyo defines innovation as knowledge creation.

“Too often innovation is about stuff. My litmus test to determine if something is really different is: can it bought, sold or replicated. If so, then the advantage may only be short

term,” said Tuyo. “To create stuff is just a point in time, but to facilitate a system of knowledge creation that is a sustainable ongoing engine, is to be able to do great every day. So it's about having an environment that allows for failure and encourages constant refining.”

To that end his weekly and monthly meetings feature the question, how will you put into practice what was learned since the last meeting? In addition, a monthly fringe meeting with supervisors and senior team members is held to take a closer look at, talk through and act on what's happening outside the credit union or even the financial services industry. As part of PenAir University, in addition to a basic leadership course for new managers, an advanced leadership institute has been created in conjunction with the University of West Florida. Twelve future leaders are split into two groups and given the opportunity to not only explore the full scope of projects across the organization, but also work on researching and developing initiatives they feel PenAir should pursue.

“When they get that scope early on of how IT, accounting, sales, operations, compliance, how the whole comes together it can only make us as an organization stronger,” said Tuyo. “And the other group that works on the research project process looks at what's going on in the fringe and submits their findings to a committee consisting of me and the senior team, and they choose the one they want to go with. Again, it's about increasing interaction, critical analysis and thinking about what we as an organization want to create.”

Looking at the credit union industry as a whole he said too often credit unions point to other area credit unions as the competition.

“It's a short-sighted view because just looking in my market, all the credit unions together have 17% of that market share. That means we have 83% we can go after,” said Tuyo. “If we have more collaboration among ourselves we would do so much better as far as competing against banks. We have to get better at sharing our credit union story and make our focus not about products or stuff but people. We need credit union evangelists in the marketplace. We can have the products members need and want, but at the end of day it's the focus on our people and communicating with them in the right way at the right time. That's what changes the world.”

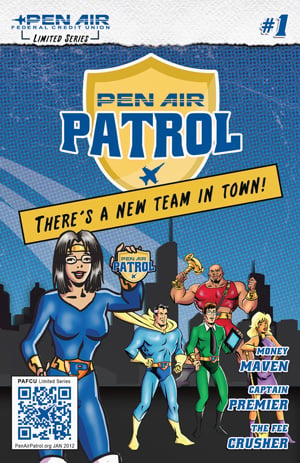

He added that credit unions have a historic opportunity to get out and share their story and connect within their communities in a new way. At PenAir FCU, a new awareness campaign has literally helped the community view the team as heroes. Playing on a comic book theme, the Pen Air Patrol, consisting of Money Maven, Debt-Free Diva, Captain Premier, Fee Crusher and The Funder, was formed to help save locals from the “greedy hands of bad banks.”

The superheroes can be spotted on billboards, comic books and even as life-sized stand ups in branches. They even created a full back story for the characters at www.penairpatrol.org.

To Tuyo, the superhero characters basically embody what staffers at PenAir FCU do every day.

“We have such an amazing team of great talent who are resourceful and ready to help guide members to the bright futures they deserve,” said Tuyo. “It's an aggressive campaign where we are saying how we are different. What better way to tell our story in this creative way? The villains are spot on and I think it's like lightning in a bottle.”

PenAir has also started a CUSO called CU Sparks with an eye on sparking innovation across the industry.

“The goal is to partner with 10 to 15 credit unions across the country, to meet with these all stars, brainstorming spending time on innovation with a focus on operations driven efficiency to a whole new level,” said Tuyo. “With all everyone has to do at their own credit union there is little to no time to think and take on a business challenge individually or as a movement and really create something special. It's not about products but more the various challenges we're seeing with C-level executives. It's a proving ground so from benchmarking strengths to people to innovation it would allow us to do that on a daily basis. The credit union movement can be a solution for society and touch members and communities we serve in more ways than just money.”

//

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.