Most would agree that the platform side of the branch plays a critical role in the success of branch network profitability. Yet management has struggled with fully understanding the overall performance in the lobby due to various systems capturing fragmented sales/service information such as DDA systems, time/deposit systems, loan systems and credit card systems—and in most cases no dedicated systems for tracking lobby service.

Financial institutions may perceive their less-than-ideal handle on lobby performance to be sufficient and do not see a remedy worth the expense or the disruption. However, a recent study indicates that lobby performances are having a much greater impact on the bottom line than previously thought.

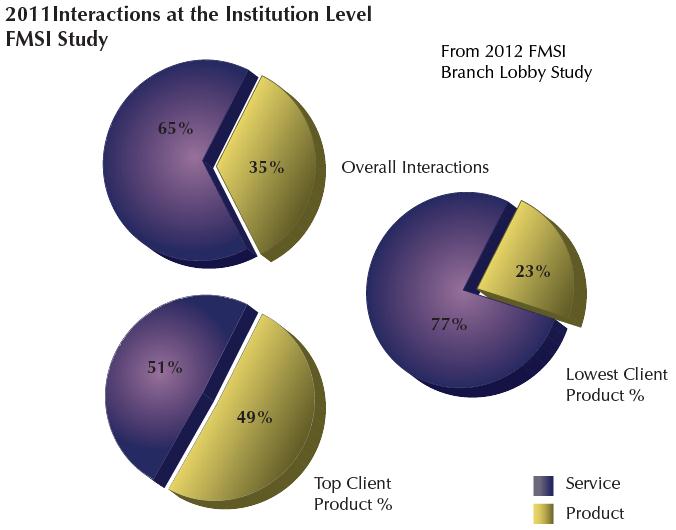

Specifically, in the FMSI branch lobby study of 344,000 interactions, FMSI found that on average 65% of the platform activities do not involve selling products. With sales being such a vital part of most branch operations, this number has been alarming for many— especially for the bottom institution of the study who had only 23% of their platform activities involving selling new products.

Other disparities from the study include vast differences in member wait times (top performers vs. group) and average assist times between account holders and lobby service representatives (top performers vs. group).

There are several approaches financial institutions can take to improve their lobby performance; and clearly defining the role of the lobby service representatives is the foundation for any enhancements. Is the lobby service representative an order taker or a professional sales consultant? Should they be spending the majority of their time handling service related interactions or selling products? Once you have determined what you want out of your lobby employees, you can employ some or all of the below tactics to turn your lackluster lobby performance around.

Utilize Extensive Reporting to Support Decisions

Leveraging retail branch business intelligence in order to improve lobby sales and service performance needs to be an everyday initiative, with an emphasis during periodic reviews. By collecting and displaying the right data, queue management systems—which are Web-based applications— help establish the procedures that drive the right employee behaviors, such as stronger specific product sales and eliminating excessive account holder assist times.

Channel Lobby Service Traffic to Call Center

Many of the simpler interactions that take place in the lobby between the account holder and the service representative are better suited to be handled over the phone by the institution's call center. This option provides account holders with convenience. They would not only save time waiting for a service representative, but they would also avoid the inconvenience and time associated with driving down to the branch.

To avoid keeping the right account holders away from your lobby, it is important to note that simpler interactions should be clearly defined and carefully communicated to your account base.

- Work with your marketing team on developing the right email and/or direct mail communications to promote this message.

- Train your branch service representatives to offer the suggestion when appropriate.

- Display signs at the branch.

- Have a dedicated call center phone and/or a kiosk in the branch.

Deploy Self Directed Technology — Like Kiosks

There are sophisticated self-directed technologies in the marketplace enabling account holders to complete some lobby interactions, such as NCR's new Video Teller Machines and interactive Kiosks. Investing in this technology can decrease wait times, reduce labor costs, portray your branch as being technologically advanced, and gives access to branch services outside regular branch hours.

Migrate to an Online Sign-In Process

An electronic queue management system moves all the information flow online. Designated financial institution employees, including senior-level staff, can see real-time views of account holders waiting in their lobby. The result is a systematic tracking system that establishes accountability on the platform side of the branch.

Outbound Call Management During Slow Periods

Improving product sales requires great follow-up activity. Set weekly outbound call goals for your service representatives. Measure these activities and manage the behavior through key performance management information.

Whether branches are suffering from lackluster lobby performances or not, the platform side of the branch deserves a closer look to determine if the actual performance is achieving the desired sales and service results. The impact on the bottom line can be much more harmful than previously thought.

W. Michael Scott is president/CEO of Financial Management Solutions Inc. in Alpharetta, Ga.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.