While the 550,000 policyholders of the newly restructured CMFG Life Insurance Co. may not see any substantial changes, the firm's parent company is looking forward to how the move will help it diversify and expand beyond the credit union industry.

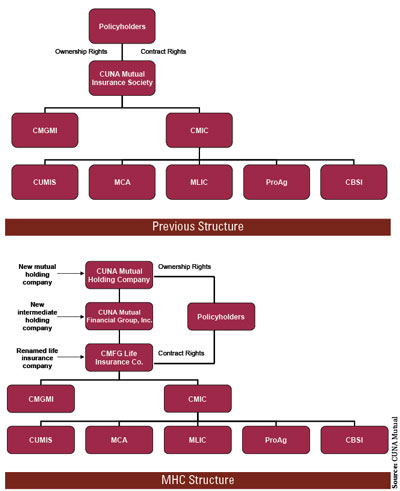

Effective Feb. 1, CUNA Mutual Insurance Society reorganized to a mutual insurance holding company structure, according to CUNA Mutual Group. CUMIS' new name is CMFG Life Insurance Co.

The company will continue to be mutually owned with the same policyholders having full ownership of the new parent mutual holding company entity, according to CUNA Mutual. In addition, the new mutual holding company and its subsidiaries will continue to use the trade name CUNA Mutual Group.

Recommended For You

Insurance policies and annuity contracts remain the same, and policyholder benefits and rights will not be reduced or altered in any way, according to CUNA Mutual. Nor will premiums increase as a result of the mutual holding company reorganization.

For policyholders, the biggest change will come on the administrative end, said Jim Buchheim, vice president of corporate communications at CUNA Mutual. All forms will bear the new name. Credit unions were first told about the potential of a new holding company structure in October 2011 and the communication continues to this day, he added.

When it came time to vote on the new structure, 93% of those who voted, which was more than 80,000 of policyholders, were in favor on the change, Buchheim said.

To explain how CMFG is poised to grow into new channels, Buchheim went back in history to when CUNA Mutual was founded in 1935 to serve credit unions.

"That remains the core of what we do," he emphasized.

Four years ago, the company set out to diversify beyond the credit union market but in a manner that would not take away the company's focus from its core group, Buchheim said. That approach involved several acquisitions, including the 2009 purchases of CPI Qualified Plan Consultants, a 401(k) provider and ProAg, a crop insurer, which CUNA Mutual first partnered with in 2007.

In July 2010, CUNA Mutual said institutional investors bought $85 million in fixed-rate, 20- year surplus notes to support its credit union market and diversification strategies, including acquisitions and investment in business-to-consumer initiatives in the credit union marketplace.

Buchheim said CPI and ProAg continue to perform well and CUNA Mutual is currently looking at more growth opportunities to cultivate from both companies.

Meanwhile, under CUNA Mutual's previous holding company structure, there were some limitations. The main one was corporate goodwill, which means if a company was bought for a set value, it can be carried on the balance sheet, Buchheim explained. However, if the acquiring company is paying for a future revenue stream, it becomes a tangible that cannot be carried.

"Under a mutual insurance company [structure], we would have reached capacity on how much goodwill we would have on our balance sheet," he said. "Technically, we hadn't reached our capacity, but we were approaching it."

The new mutual holding structure removes those obstacles and CUNA Mutual can now evaluate and assess potential acquisitions that will help the company grow, Buchheim said. To that end, a business development unit was formed in 2009 to help mine prospects.

Buchheim said while there aren't any acquisitions on the immediate horizon, the company continues to look at its existing product and services to find channels to build on. For instance, CUNA Mutual's Smartphone Loan, which is a mobile version of loanliner.com, its online lending platform, made its debut last year. Other opportunities in consumer loans and life insurance are being examined as well.

CUNA Mutual is already seeing the connections between its recent acquisitions and its long-term ties to the credit union industry, Buchheim said. The steps have allowed the company to reinvest more in its systems and maintain support from CUNA and leagues.

"At the core of this move is helping us better execute the strategy we have, which is to focus on the credit union system but to also grow beyond and diversify," Buchheim said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.