Saving cash by handling cash better was just the beginning for Amanda Hamm and Public Service Credit Union.

Hamm is the efficiency officer at the $1.3 billion Denver credit union, a newly created job she assumed just a few years ago. Already, she’s saving PSCU about $350,000 a year, she said, and, with her colleagues and some souped-up reporting software, they’re shooting for more in 2012.

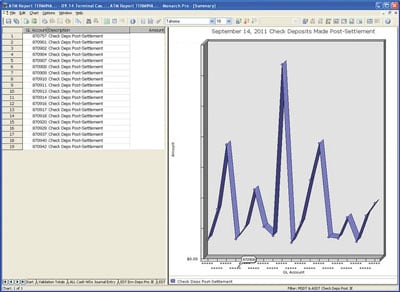

The software is the Monarch Pro enterprise reporting platform from Datawatch, an analytics solution provider the credit union uses to translate and manage reports in multiple data formats. It is also distributed to managers in ways they can then understand and use to improve internal processes and member service, according to PSCU.

One of the first ways they’ve done that is by improving cash handling at the 133,000-member credit union’s network of 67 ATMs and 30 branches across the front range of the Rockies, Hamm said.

Hamm has used the Monarch platform to create dashboards that showed the branch and ATM managers how much cash they were using and when. It also allowed them to even get competitive with each other about how much more efficiently they could handle that ordering and inventory process.

“It appealed to their competitive nature and now it’s almost fun for everyone to see how much more efficient we can be, instead of everyone basically just ordering cash whenever they thought they might need it without any thresholds or time frames,” Hamm said.

They also were able to take on in-house work that was outsourced to cash vendors. That move has amounted to savings of about $55,000 a year they were spending on ATM cash management and about $9,000 a week more in savings from branch cash management, she pointed out.

Another area of measurable savings has been in indirect lending, Hamm said.

“We outsource our indirect lending to dealerships and get a slew of data from different sources that we have to consequently perform different reports on each day,” she said. “We were able to create a model to automate many of those processes, including a massive journal entry that had to be manually done.”

Now, that four-hour task takes about 15 minutes, which allows that department to leave empty a position that had become open through attrition.

About 30 of the credit union’s 350 employees use the Monarch solution. The finance and accounting departments are a particular hot spot for “power users” who have helped PSCU save about 2,000 hours of process time a year so far.

“Our accounting department began using the Datawatch Monarch platform in early 2009 to improve the usability of our general ledger data. They experienced such great results that we decided to expand the tool’s usage by educating and allowing other departments of the credit union to utilize it as well,” Hamm said.

That includes payment systems managers who deal with massive ACH and other electronic transaction reports.

Hamm noted that most senior staff, including branch managers, don’t actually use the software, just the reports generated from them. They do, however, let Hamm and the other Monarch users know what reports they do need, and together they’ve collaborated on more than 200 different models so far.

“They have sort of the perfect environment for our solutions,” said Michael Morrison, president/CEO of Datawatch in Chelmsford, Mass. “Our strength is taking existing reports – and we use the term ‘report’ quite broadly – out of transaction and other systems in a variety of formats and pulling the relevant data out of it and making it useful.”

That includes HTML, PDF, electronic data interface and other widely used and more obscure formats, and especially Excel, where the Monarch software has eliminated the need for staff to spend hours typing in information from the other sources.

Morrison said more than 550 credit unions are among his company’s approximately 40,000 customers worldwide, noting that the financial services industry is a prime user of enterprise reporting platforms.

“They have a lot of fairly challenging reports,” he said, that can take advantage of enterprise resource planning technology to “integrate static information that’s not been integrated, put it in a dynamic framework and then apply analytics that allow you to filter, slice and dice it.”

That allows branch managers and senior executives alike to drill deeper into the information, compare different elements of data and visualize it in ways that make sense for them, Morrison said.

At PSCU, Hamm said she’s now involved in helping to train user groups on the Monarch software, holding quarterly classes for beginners and advanced users who can now create, analyze and act on verifiable data without spending untold time on custom programming.

Going forward, Morrison said Web-based data formatting, analysis and delivery are increasingly in demand.

“In the old days, Excel and PDFs were sufficient,” he said. “Now, people want to go to the Web in a self-serve environment.”

Datawatch is expanding its delivery of that and Hamm said PSCU is interested.

“We’re looking to move to Web-based,” she said, “so the reports we generate can be more easily communicated to all 30 of our branches.”

While PSCU’s senior management doesn’t use the tool itself, they do receive the reports that are generated, Hamm noted.

“We’re always working to be able to tell them, ‘If you can see it, we can do it.'"

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.