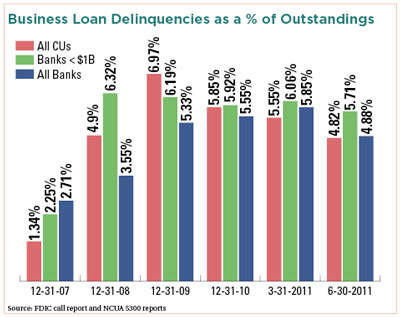

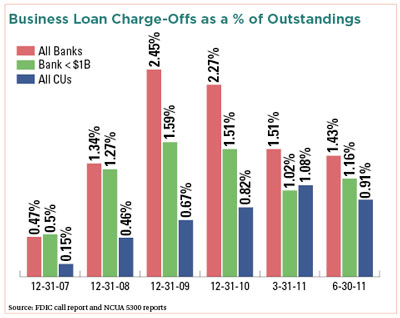

If credit unions are looking for proof that they can manage loans better than their bank competitors, it would likely be with delinquencies and charge-offs.

Since 2007, credit unions' loan losses have trailed banks in both areas, according to data tracked by CU Business Group, a Portland, Ore.-based business lending CUSO serving more than 360 credit unions.

Meanwhile, even as the industry experienced sluggish loan growth, several credit unions experienced double digit percentage increased in their auto and first mortgage originations among others.

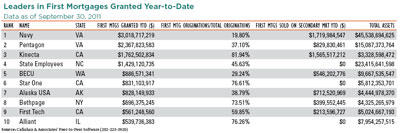

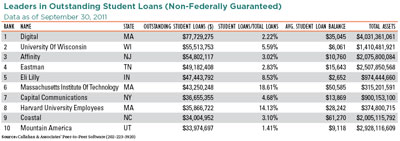

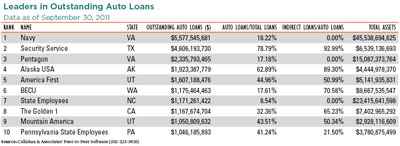

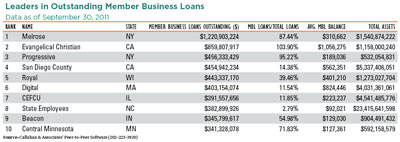

The 10 credit unions with the highest outstanding auto loan portfolios were all members of the billion dollar asset club with Navy Federal Credit Union topping the list, according to Callahan and Associates Inc.'s data as of Sept. 30, 2011. Navy Federal also ranked first in first mortgage originations. New York and California credit unions commanded the top four spots in the member business loan growth category while the $4 billion Digital Federal Credit Union was the clear leader in the non-federally guaranteed student loan ranking.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.