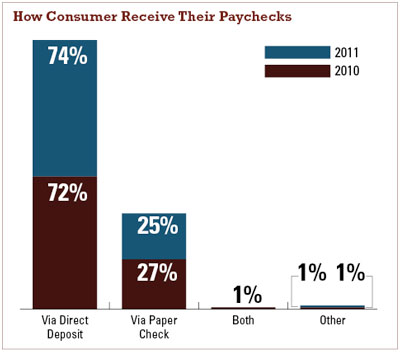

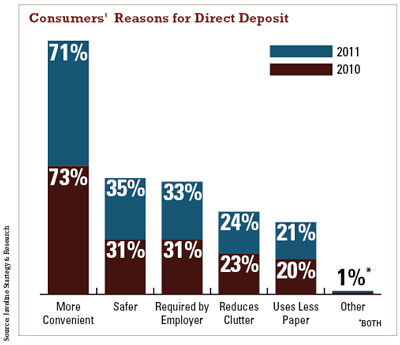

Three out of four employees use direct deposit for payroll and one out of four still receive paper checks, said a new survey from NACHA, the electronic payments association. The survey revealed a 2% increase in direct deposit use, from 72% to 74%, and 71% of employees cite convenience as their primary reason for using direct deposit.

The survey, which was conducted from a random sample of 3,502 respondents, also found 17% of employees are splitting their direct deposit funds over two accounts, which is a 3% increase from 2010.

NACHA said those 83% of employees who do not split their direct deposits into multiple accounts are missing out on a simple way to save. According to a 2007 NACHA survey, employees save 30% more on average when they deposit money into their savings accounts through a split direct deposit as opposed to making manual deposits.

Recommended For You

Survey respondents listed other top reasons for opting into direct deposit as safety (35%), employer requirements (33%), clutter reduction (24%) and reduced environmental impact (21%).

The results present credit unions with an opportunity to share the benefits of a direct deposit program with their small business members, said Bill Sullivan, senior director and group manager of industry and government relations for NACHA.

"There is a lot of opportunity for credit unions to encourage direct deposit use from their small business members," Sullivan said. "One half of small business non-users report they have not been contacted by anyone about direct deposit. By simply reaching out to small business members and emphasizing the time and cost savings and environmental benefits afforded by direct deposit, credit unions may help businesses make the switch."

NACHA also looked at the direct deposit behaviors of Gen Y and found 72% of employed Gen Y consumers receive their pay through direct deposit. The majority of Gen Y employees, 70%, also name convenience as their top reason for using direct deposit.

Gen Y is more likely to split their direct deposit funds over multiple accounts, the survey found. 23% of employed Gen Y consumers split their direct deposit paychecks over two accounts, and 8% split their funds over three accounts.

The survey also revealed that 78% of "early adopters," employed consumers who consider themselves the first to try new technology, use direct deposit. This demographic is also more likely to split their direct deposit funds over multiple accounts–28% of early adopters split their direct deposit paychecks over two accounts. The majority of early adopters, 64%, also name convenience as their top driver of direct deposit use, but a significant percentage of early adopters, 46%, named safety as their top motivator.

NACHA measured early adopters up against "cautious adopters," who wait for their friends to try new technology first, and "laggards," who will only try new technology after it's been available for a long time and everyone is using it, both of which are less likely than early adopters to use direct deposit or split their direct deposits over multiple accounts, the survey found.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.