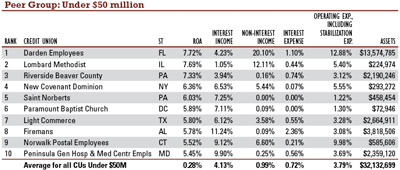

Some credit unions are achieving high ROAs despite the rough economic times of the last three years. Among credit unions under $50 million in assets, $13 million Darden Employees hit 7.72% ROA, while teeny Lombard Methodist ($224,974) made the second spot on the list at 7.69%.

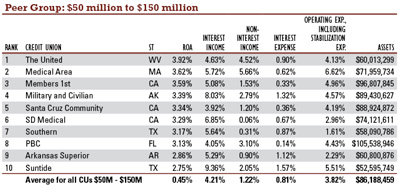

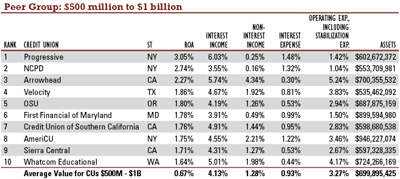

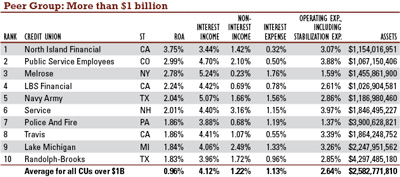

At the other end of the asset-size spectrum are the likes of $900 million First Financial of Maryland and $4.3 billion Randolph-Brooks. The highest average ROA still went to the largest credit unions at 0.96% for credit unions with more than $1 billion in assets and 0.67% for credit union between $500 million and $1 billion in assets. That declined to 0.58% for credit unions $150 million to $500 million and to 0.45% average ROA for credit unions between $50 million and $150 million in assets. Credit unions under $50 million in assets averaged 0.28% ROA.

Interestingly a few credit unions under the NCUA's management made the lists of top ROA achievers, including AEA Federal Credit Union and Arrowhead Credit Union.

It's not just the big guys earning top ROA marks. Check out $73,000 Paramount Baptist Church making the top 10 list.

Don't rule the sand states out. California credit unions make a few appearances here.

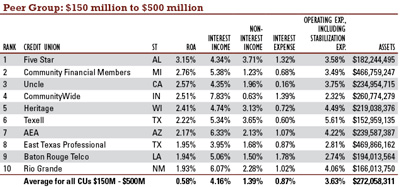

Five Star Credit Union at $182 million in assets earned the highest ROA in this asset bucket.

In this asset category, New York State ruled the day with three credit unions earning top slots: Progressive, NCPD and AmeriCU.

North Island Financial tops the list of the largest credit unions when it comes to ROA. Rounding out the top three were Public Service Employees of Colorado and Melrose of New York.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.