WASHINGTON — Whether the change involves "major surgery" as House Financial Services Committee Chairman Barney Frank promises or the political equivalent of a tummy tuck, the way the government regulates financial services probably won't be the same after Congress and the next president are finished.

The problems of certain banks and credit unions–as evidenced by the wave of mergers and closings–coupled with the tendency of Democrats toward more policing of the marketplace could cause financial institutions to face more oversight.

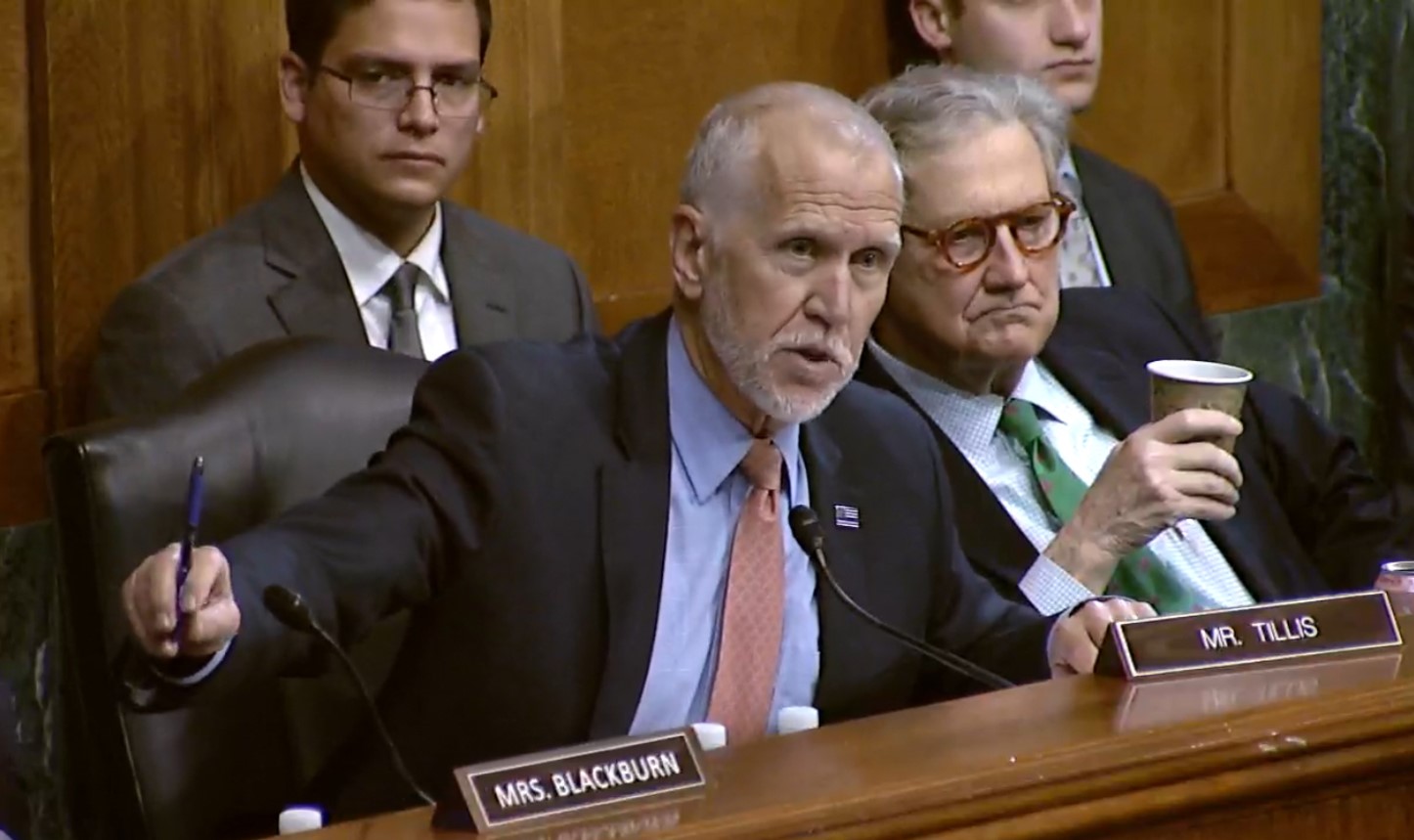

Frank has said he favors keeping the tax-exempt status of credit unions and having them keep an independent regulator. His Senate counterpart, Banking Committee Chairman Christopher Dodd has been a friend of credit unions but hasn't made the same expressions of support for them as Frank.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking credit union news and analysis, on-site and via our newsletters and custom alerts

- Weekly Shared Accounts podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the commercial real estate and financial advisory markets on our other ALM sites, GlobeSt.com and ThinkAdvisor.com

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.