It was a big, hairy, audacious goal for the $1.4 billion Elevations Credit Union.

In fact, it was so audacious that Gerry Agnes, president/CEO, seriously doubted his Boulder, Colo.-based cooperative would achieve it before the sun set on his career. That goal was for Elevations Credit Union to receive the Malcolm Baldrige National Quality Award, which is what some call the Academy Award of business.

But on Nov. 10, 2014, Agnes got the congratulatory call from U.S. Secretary of Commerce Penny Pritzker that Elevations Credit Union had indeed achieved its big, hairy, audacious goal.

What's more, Elevations Credit Union was the first credit union to have received the Baldrige Award. The 2014 Baldrige Award was presented to the credit union during a ceremony at the Quest for Excellence conference in Baltimore, Md., held earlier this month.

“When we introduced and adopted that goal, my comment was, it's likely that this may not happen in my career, and that's OK,” Agnes said. “It's not about receiving the award. It's about getting better tomorrow than we are today. We were obviously very pleased that we received it as early as we did…on our very first application.”

He first heard about the Baldrige Award in 2000 and was impressed by the companies such as the Ritz Carlton and Motorola that had been past recipients of the award, which is considered the highest level of national recognition for performance excellence that a U.S. organization can receive.

Malcolm Baldrige was the U.S. Secretary of Commerce from 1981 until his death in 1987. He was a proponent of quality management as a key to the country's prosperity and long-term strength. In recognition of his contributions, Congress named the award in his honor in 1987.

In July 2008, Agnes was being interviewed for the president/CEO position at Elevations Credit Union by a board of directors that was very concerned about the impact of the Great Recession. Consumers weren't buying or borrowing, membership growth was anemic and employee morale wasn't strong. So, he introduced the Baldrige concept and how it could be applied to make the Colorado cooperative stronger.

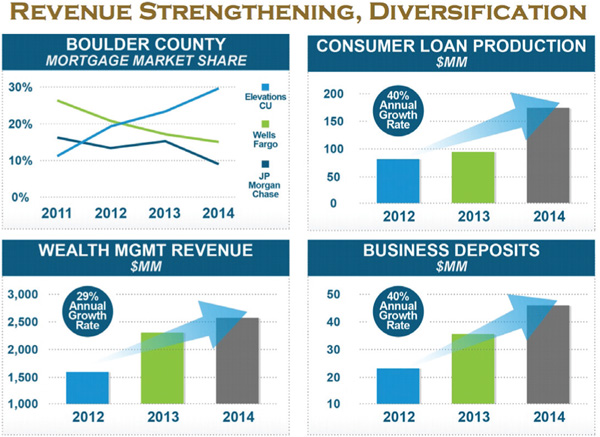

As illustrated in the chart to the left, Elevations Credit Union beat out competitors in several performance areas.

“The board was looking for a bold new direction, and I ended up becoming the successful CEO candidate in August 2008,” he said.

But in the early days of its Baldrige journey, the credit union slogged through some challenging times.

“Shortly after I got here, we wrote down our capital from 8.5% to 7%,” Agnes said. “Our environment with our regulator was very, very difficult. We fairly quickly restored that relationship and our capital, but it was a very difficult time.”

Additionally, in December 2009, Elevations closed a Denver area branch and laid off 13 employees, in part because local retail and residential developments were never built. At that time, Agnes said he didn't see market conditions changing substantially over the next several years.

“Looking back, people were asking, 'Why would you invest all of the time, the money and the human capital into this big, hairy, audacious goal at this critical point when you should be worrying about surviving?'” he said. “Survival was never a question in our mind, but thriving in any economic environment was. This investment was the right investment at the right time. It couldn't have been better for us.”

In simple terms, the Baldrige program provides a framework for organizations to assess and improve their operations based on management by facts to achieve continuous performance excellence in the critical areas of leadership, strategy, customers, measurement, analysis and knowledge management, workforce, operations and results.

An important part of the Baldrige methodology, Agnes explained, is that it is a very rigorous and disciplined process that requires validations, which are audited by industry experts.

“The Baldrige framework asks 255 very important questions that every leader should be asking in any organization,” he said. “And if you answer them honestly, you can make some tremendous progress.”

For Elevations Credit Union, its progress facilitated by the Baldrige program eventually produced some impressive results.

For example, the credit union's mortgage production volume increased from 1,124 loans in 2011 to 2,307 in 2014 and it is now the largest credit union mortgage lender in Colorado.

What's more, despite the tepid economic recovery, the cooperative's total loan portfolio grew from $613 million in 2010 to $895 million in 2014, according to NCUA financial performance reports. Elevations Credit Union also reported a 29% annual growth rate since 2012 in wealth management revenue and a 40% annual growth rate since 2012 in business deposits, which are also helping to strengthen its revenue diversification.

From 2009 to 2013, Elevations Credit Union has also seen an annual membership growth rate of 6% compared to a 1% annual membership growth rate among its peer group average.

The Colorado cooperative also moved the needle in net promoter system surveys, which measure and compare member engagement and loyalty. Its NPS relationship score increased from 35 to 50 since 2011, and its NPS score for overall transactions improved from 52 in 2011 to 65 in 2014. For new product transactions, the NPS score went from just over 60 in 2011 to 80 in 2014.

Months after educating the executive team and entire staff about the Baldrige framework, employees began the detailed grunt work to answer the Baldrige 255 questions on how the organization operated in the critical areas of leadership, strategy, customers, measurement, analysis and knowledge management, workforce, operations and results.

In those critical areas, the credit union's employees formed their answers by evaluating every single process within their organization that opened the opportunity to create systematic, repeatable processes that would be superior in the marketplace and can be readily duplicated, Agnes explained.

Elevations Credit Union President/CEO Gerry Agnes, pictured here, said he hopes other credit unions can learn from his staff's Baldrige journey.

But what enabled employees to answer those critical questions was the fact that the Baldrige framework was a conduit that led to a safe environment where they could speak honestly.

For example, before Agnes became CEO, it was taboo for employees to complain about the problems and limitations of the credit union's core operating system because the previous leadership was married to it.

Soon after Agnes began talking about the Baldrige process and creating a comfortable environment for employees to answer the Baldrige framework questions truthfully, an executive at a planning meeting asked a key question that should have been asked years ago.

“The question asked was, 'When are we going to address our core operating system?'” he said. “There were probably 15 to 18 people in the room, and you could hear a pin drop because someone just asked a question that was taboo to ask before.”

So, following the Baldrige framework of gathering information and facts, employees were asked how the core operating system allowed them to help members. It turned out everyone in the credit union thought the operating system was horrible.

“So when the staff started seeing the question about the core system asked and answered and no one got reprimanded or fired, they realized it was safe to ask these questions,” Agnes said. “The bottom line is that the staff wants to be seen. They want to be heard. They want to be valued. Once they saw we started listening and taking action on their recommendations, the momentum within the organization started accelerating in the right direction.”

Although the Baldrige process is not for everyone, Agnes believes many credit unions, regardless of their asset size, can benefit from it.

Companies that receive the Baldrige Award are required to share their learnings with others.

On June 4 and Oct. 2, Elevations Credit Union will be hosting full-day sessions to share the lessons learned along its Baldrige journey at the Wilderness Peaks Service Center in Boulder. For more information, visit elevationscu.com/sharingdays.

“It is our hope that other credit unions can learn from our experience and become better at what they do for their membership,” Agnes said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.