To enhance customer service, improve operational efficiency and entice new members, especially younger ones, credit unions of all sizes are tapping into new technology such as social media and rolling out cool tech tools such as mobile apps and video tellers.

Yet, credit unions face challenges selecting from the plethora of products and providers entering the market. Tighter IT budgets make it imperative to find cost-effective solutions that engage members across multiple channels.

According to Callahan & Associates' latest Technology Priorities Survey, about 60% of credit unions that participated in the survey have earmarked funds this year to introduce or upgrade some form of mobile banking, such as Short Message Service (SMS) or Remote Deposit Capture (RDC).

“From the credit unions surveyed, 56% of respondents plan on adding an app while 44% plan to improve on an existing iPhone or Android app,” said Parth  Kapoor, an industry analyst with Callahan in Washington, D.C. “From those surveyed, 21% want to build mobile compatible websites while 50% will focus on tweaking their mobile browser pages. Mobile banking through text is a priority for credit unions as well, as 37% of credit unions surveyed plan to either improve or implement an SMS mobile banking solution.”

Kapoor, an industry analyst with Callahan in Washington, D.C. “From those surveyed, 21% want to build mobile compatible websites while 50% will focus on tweaking their mobile browser pages. Mobile banking through text is a priority for credit unions as well, as 37% of credit unions surveyed plan to either improve or implement an SMS mobile banking solution.”

Credit unions offering remote banking services are reaping benefits, Kapoor said.

“As of March 2013, credit unions above $20 million that did not offer remote deposit capture or mobile banking had average loan balances of $11,586 with average share balances of $8,512 for those credit unions,” he added. “For credit unions above $20 million with remote deposit capture and mobile banking, loan balances averaged $13,918 while average share balances were $11,000 for the first quarter of 2013.”

To maximize return on investment, experts say, credit unions should closely explore members' needs and think strategically before implementing new technology. Selecting the right technology enables them to compete with national banks and offer benefits on the balance sheet as well.

“Thanks to innovation, branches no longer have to function as the sole place for simple banking transactions,” Kapoor said. “By processing basic tasks and transactions, remote services offer credit unions the ability to be wherever members are without having a physical presence.”

Here's a closer look at five tech tools for CUs:

Mobile Remote Deposit Capture (RDC)

Although there are some security concerns about RDC, mobile banking continues to gain consumer confidence with almost 30% of cell phone by tapping into mobile banking services, according to a recent report by the Federal Reserve.

(Below, a check image on Wright-Patt CU's RDC solution. Click on image to see it enlarged.)

For some credit union members, mobile is the first choice. About 15% of consumers prefer to check their financial accounts on a mobile device, according to a recent study by PFM software provider Quicken, an Intuit company.

For some credit union members, mobile is the first choice. About 15% of consumers prefer to check their financial accounts on a mobile device, according to a recent study by PFM software provider Quicken, an Intuit company.

As a result of the increasing popularity of mobile banking, a growing number of credit unions are introducing mobile RDC and many are reporting positive feedback from members.

More than 60% of participants in the Technology Priorities Survey plan to add RDC this year while 27% plan to upgrade an existing offering, Callahan said.

Since launching its mobile RDC feature on March 27, the $2.6 billion, 250,000-member Wright-Patt Credit Union in Fairborn, Ohio, has processed mobile deposits for more than 4,000 users, said Tracy Fors, WPCU's vice president of marketing and business development.

Smaller CUs are also jumping on the mobile RDC bandwagon, citing the affordability of launching mobile apps. For instance, the $25 million, 4,000-member Tri-Cities Credit Union in Kennewick, Wash., recently rolled out a mobile deposit app which cost less than $5,000 to implement, according to Tri-Cities President Doug Wadsworth.

Next: P2P Mobile Person-to-Person (P2P) Fund Transfers

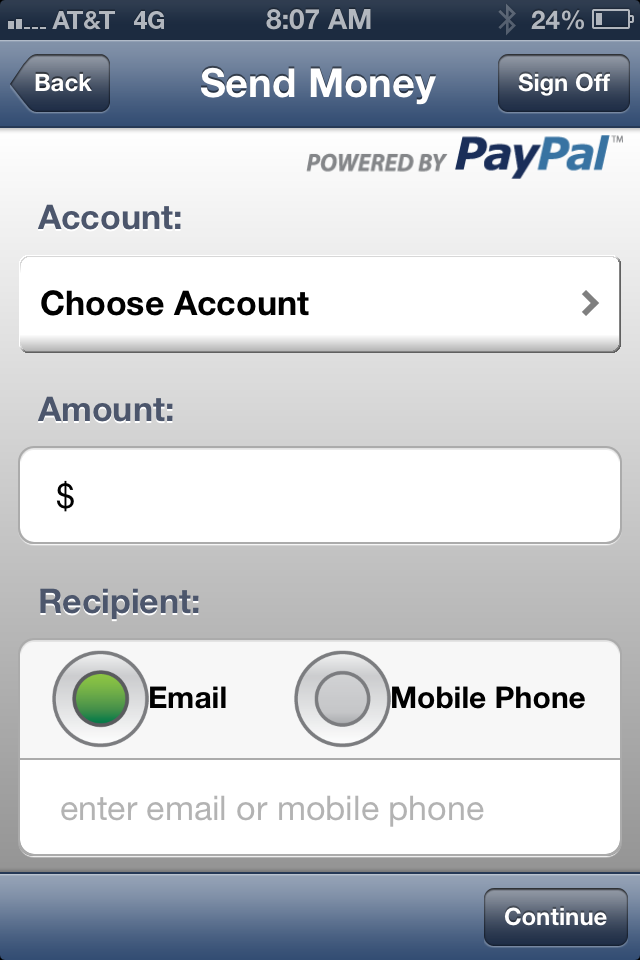

(At left, click to see enlarged image of Financial Partners CU's PayPal-driven P2P offering.)

The $793 million Financial Partners Credit Union in Los Angeles recently launched a mobile P2P service powered by PayPal. During the first few weeks of rolling out the new mobile service, Financial Partners said it processed more than 100 mobile P2P transactions, totaling $7,000.

Although many credit unions are debating the merits of P2P, some experts expect continued growth.

Monett, Mo.-based Jack Henry & Associates Inc., which owns Symitar, a provider of core processing solutions to about 790 CUs, reported recently that its iPay Solutions processed more than 1.8 million payments, totaling more than $1.2 billion, in the last six months of 2012.

More than 2,700 financial institutions, including 1,900 credit unions, use the iPay Solutions bill pay platform in which the P2P functionality is integrated and usage is increasing, according to company officials.

“We believe the ongoing evolution of mobile devices and their prevalence in daily financial management will surely support a significant rise in P2P adoption,” said Greg Adelson, group president of iPay Solutions. “We have clearly seen exponential growth in the number of subscribers and transactions as well as transaction amounts for the last few years.”

Next: Social Media

Social Media

By now, most credit unions utilize social media to engage members, but some are taking it to the next level.

For example, the $718 million Vantage Credit Union of Bridgeton, Mo., which recently joined the growing number of credit unions offering mobile apps, is also using Facebook and Twitter in unique ways, said Jenn Cloud, Vantage's social media specialist.

Recently VCU used Facebook to help a member retrieve $1,000 lost during a vacation in New York City.

VCU also uses Twitter to engage members. In 2009, the CU launched TweetMyMoney, which allows members to monitor account balances, deposits and withdrawals, holds and cleared checks with simple commands via Twitter. In addition, they can transfer funds within their accounts to avoid overdraft fees.

To improve security, Cloud said, TweetMyMoney uses Twitter's direct message feature and the information contained in tweets are generic from Twitter hash tag commands. Now that Twitter has gained more traction with the general public, Cloud said, VCU plans to further develop TweetMyMoney and encourage more use among members.

“Our user base is still modest as we are just now assigning a product manager to develop it but the active members we do have are active and average about three to four inquiries per month through it,” she said. “They find it to be a fast, efficient way to check their balance, recent transactions and make quick transfers with a few simple codes!”

Next: PFM

Personal Financial Management (PFM)

Approximately half of U.S. consumers that participated in a recent survey by Javelin Strategy & Research said they want a single view of their finances and would be most likely to use a PFM tool offered through their credit union or bank.. To respond to that demand, CUs across the country are offering PFM tools.

For example, to enhance functionality for the soaring number of members using computers and mobile devices, the $808 million, 106,000-member Credit Union ONE in Ferndale, Mich. said it is updating its online banking platform and adding new personal financial management tools. The soon-to-be released platform features brand logos for retail account transactions, online bill pay capabilities and helpful graphics that offer members a visual tool to assist with budgeting.

“With the new system, our members will have the accessibility for Bill Pay Quick Pay, a transaction history, budgeting tools, alert setting, and many other user-friendly tools, including a dashboard that they can customize to view whatever information they would like to see in the order that best suits them,” said Judith Desilets, CU ONE's director of public relations.

To reap the most benefits from PFM tools, experts say, CUs need to capture data accurately, analyze it efficiently and utilize it strategically.

In order to make the most out of PFM, the $1.3 billion Local Government FCU in Raleigh, N.C., recently inked a deal with Provo, Utah-based MoneyDesktop, according to Maurice Smith, president/CEO of Local Government FCU and chair of the North Carolina Credit Union League.

Smith said Local Government CU is participating in the private beta testing phase of MoneyDesktop's new PFM-based analytics and marketing tools: Insight and Target, which were named as a Finovate Spring 2013 Best of Show winner.

Smith, said his credit union's goal in implementing Insight and Target is to improve efficiency in marketing products and services to members, enhance customer service and improve market penetration.

By using data-driven analytics, CUs can better understand account holders' banking relationships and create focused marketing strategies aimed at specific users, said Bret Skousen, vice president of strategic partnerships and public relations at MoneyDesktop, which claims about 400 banks and credit unions as clients.

Next: PTMs

Personal Teller Machines (PTMs)

Since the NCUA announced last fall that it would allow video tellers to count as service facilities, PFMs have been popping up at credit unions of all sizes, and industry analysts predict the machines will become commonplace during the next few years.

According to NCUA guidelines, PTMs must be physically located in the service area, provide real-time, face-to-face video access to credit union or shared branching employees during regularly scheduled hours, and allow the member to conduct all transactions in order to qualify as a service facility.

According to NCUA guidelines, PTMs must be physically located in the service area, provide real-time, face-to-face video access to credit union or shared branching employees during regularly scheduled hours, and allow the member to conduct all transactions in order to qualify as a service facility.

Video tellers such as NCR's APTRA Interactive Teller can speed transactions by roughly 33% compared with an in-person transaction, according to Brian Bailey, vice president and general manager at that company.

To enhance efficiency and engage members who prefer electronic options, an increasing number of CUs are deploying video tellers. For example, PFMs have recently been installed at the $2.6 billion, 250,000-member Wright-Patt Credit Union in suburban Dayton, Ohio, and the $3.5 billion, 420,00-member Mountain America Credit Union in West Jordan, Utah.

Video tellers are also helping CUs cut costs. According to a video case study created by NCR, the $2.2 billion, 180,000-member Coastal Credit Union in Raleigh, N.C., has reduced the cost of teller services by about 40 percent by installing PFMs.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.