Credit unions of every shape, size and type recognize the benefits that mobile banking offers – a lower cost to serve, increased member satisfaction, retention and a higher return on investment. But for many, breaking through the mobile banking adoption glass ceiling has been challenging.

The mobile banking glass ceiling lies just beyond the threshold of early adopters, designated as the first 20% of a financial institution's online banking user base. Many credit unions are on a mobile banking adoption path that attracts the early adopters within a year of offering the service, but the trajectory then stagnates to include just a small additional percentage of adopters over the next two years.

To move beyond the initial wave of early adopters and reach more members, credit unions must promote widespread consumer acceptance. By leveraging the key drivers of consumer adoption, credit unions can realize a faster rate of adoption that will establish mobile banking as the norm.

Five Factors Contribute to Consumer Acceptance of Mobile

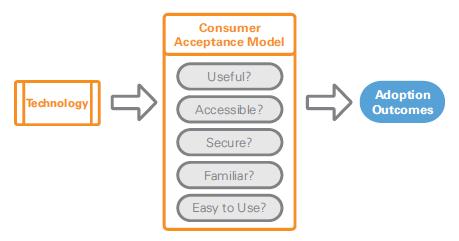

For credit unions that aspire to break through the glass ceiling of mobile banking adoption, there are five factors of consumer acceptance to consider. Consumers must decide if mobile banking services are: 1) useful, 2) accessible, 3) secure, 4) familiar and 5) easy to use. How consumers perceive mobile banking in terms of these five factors will impact the adoption outcome.

1. Making the Case that Mobile Banking is Useful

Persuasive ways to convince consumers that mobile banking will enhance their experiences include messages focused on saving time and money. Consumers today are busy and budget-conscious, so the benefits become tangible when they are reminded that mobile banking saves time and can serve up alerts and reminders that help safeguard against missed payments and late fees. Additionally, using real-life examples illustrates how mobile banking can come in handy and will benefit them in their own lives.

It also is important to keep in mind that different messages will resonate with different audiences, particularly those based on lifestyle. Busy moms, who are often on the go but may not consider themselves tech-savvy, need to be assured that the mobile banking is easy to use and offers a practical way to stay on top of their families' daily finances. Meanwhile, younger Gen Y members, who place a high degree of importance of social activities, will find a message about having more time to spend with friends to be compelling.

2. Providing Access to Mobile Banking through All Their Devices

Simply put, the more accessible a product, service or technology is, the greater the opportunity to use it. To break through the glass ceiling and attract additional users and transactional activity, mobile banking must be made more attractive and accessible. Credit unions should ensure mobile banking accessibility for as many members as possible and support multiple platforms and devices, to tap into a broader user base.

3. Helping Consumers Overcome Security Concerns

The perception that mobile banking transactions are less secure than online banking transactions is a big factor to overcome in turning skeptics into users. To convert a greater share of the mass market, perceptions about mobile security must be properly addressed.

Credit unions need to go the extra mile to help members understand that mobile banking is safe and secure. For example, a Security Guarantee or Mobile Banking Guarantee should be provided that explains how consumer information and transactions are protected, and that offers assurances, such as a money-back guarantee. Taking a proactive position to provide members with the knowledge that their privacy and transactions are safeguarded is more effective than waiting for a question that may never come.

4. Familiarity Creates a Natural Transition across Channels

Consistency in branding and experience across channels allows for an easier and more comfortable transition from one channel to another. Facebook, for example, does an excellent job of providing consistency across channels. Regardless of the channel, platform or device, consumers enjoy a consistent experience when they access their Facebook accounts. If a mobile banking offering is consistent with what is presented in other channels, consumers will recognize and feel comfortable with the service.

Credit union members should recognize the brand in the mobile user interface; the logos, graphics, colors and copy should be consistent with all other channel experiences. This includes customizing and optimizing the user interface based on the platform such as Android and iOS. The overall experience should be familiar to the member and consistent with the operating system.

5. Mobile Banking Services Must Be Easy to Use

Technology is intended to make life easier, but if it's not easy to use, only early adopters or tech-savvy consumers will continue to use the technology. In a market where new technologies and feature sets are rapidly developed and promoted as differentiators, financial institutions need to understand the importance of balancing the sophistication of the technology with simplicity for the consumer.

To ensure mobile banking services are easy to use, credit unions should deliver an intuitive user experience that eliminates the need for training prior to conducting simple activities. Communication with members via posts and collateral about the benefits and ease of use of mobile will also be effective.

Breaking through the Glass Ceiling is Achievable

For the majority of consumers, mobile technology is a part of everyday life. Credit unions can take advantage of this by focusing on mobile as a viable channel for transactions and positioning it as an integral part of the member experience.

Credit unions that successfully address the five key factors of consumer acceptance – usefulness, accessibility, security, familiarity and ease of use – and devote the time and effort to gaining consumer acceptance will be rewarded with a higher rate of adoption. Credit unions have the knowledge and capability to enable this acceptance. By acting now, you can extend the benefits of banking via the mobile channel to the broadest possible range of members.

John Moon is manager of mobile adoption marketing at Fiserv Inc. in Brookfield, Wis.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.